Sales Commission Percentages: A Guide to Fair, Motivating Pay Plans

Sales Commission Percentages: A Guide to Fair, Motivating Pay Plans

Ollie Efez

December 14, 2025•19 min read

If you're trying to pin down a "typical" sales commission, you'll find it usually lands somewhere between 5% and 20% of a deal's value. But that's a huge range, and the truth is, the number can swing wildly depending on the industry, the product you’re selling, and the salesperson’s role.

This performance-based pay is the engine that drives most sales teams. It's what directly connects a salesperson's hustle to the company's bottom line.

What Are We Really Talking About with Sales Commissions?

Think of a sales commission as a partnership made real. When a sales rep closes a deal, the company gives them a piece of the action. It's a powerful model because it perfectly aligns what's good for the salesperson with what's good for the business. When they win, the company wins. Simple as that.

But here’s the thing: the idea of a single “perfect” percentage is a total myth. The right rate isn’t some magic number you pull out of a hat. It’s a strategic figure that’s carefully shaped by a handful of key factors to create a compensation plan that actually motivates people without breaking the bank.

Core Factors That Shape Commission Rates

A smart commission plan is built around the unique dynamics of your business and sales environment. The percentage you land on is a direct reflection of what it takes to make a sale in your world.

Here’s what really moves the needle:

- Industry Norms: Every sector has its own benchmarks. A real estate agent closing a massive property deal is going to have a very different commission structure than a SaaS rep selling a monthly software subscription.

- Product Profitability: It's all about the margins. High-margin products can easily support higher commission rates. If a sale brings in a ton of profit, there’s more room to reward the person who made it happen.

- Sales Cycle Length: The effort has to match the reward. A complex enterprise deal that takes six months of nurturing and demos should absolutely command a higher commission than a quick, one-call-close transaction.

- Role and Responsibilities: A sales executive who handles everything from prospecting and lead generation to the final close and onboarding is going to earn a bigger slice of the pie than someone who only focuses on setting initial appointments.

Sales Commissions Are Earned Wages, Not Just Bonuses

This is a critical point that often gets missed: commissions aren't just optional bonuses; they are legally considered earned wages. Getting this distinction right is non-negotiable for staying compliant.

A recent New Jersey Supreme Court ruling, for example, made it crystal clear. The court’s decision drove home the point that commissions are direct payment for an employee's work and services.

The court found that commission payments are indeed direct compensation for the labor or services an employee performs—making them squarely within the definition of wages, not optional "supplementary incentives."

What this means for you is that once a commission is earned based on the rules in your sales plan, it has to be paid. You can't just change your mind or pivot your strategy and decide not to pay out what's owed. This legal clarity is exactly why having a well-documented, transparent commission plan is so important from the get-go.

While this performance model is fantastic for driving sales, it’s quite different from other incentive structures. If you’re curious about another popular model, you can learn more about affiliate marketing commission rates in our related guide. We’ll get into the specifics of different structures and industry benchmarks in the sections to come.

Common Commission Structures Explained

Picking the right sales commission percentage is only half the battle. The real art and science lie in how you structure the payout. A great commission plan does more than just reward sales; it’s a powerful tool that shapes behavior, guiding your reps to focus on what truly matters to your business—whether that’s landing new logos, maximizing profit margins, or building long-term customer value.

Getting the framework right is the difference between a fired-up, motivated sales team and one that's confused or just going through the motions. Each of the structures we'll cover offers a different blend of risk and reward, creating a unique incentive system for your reps.

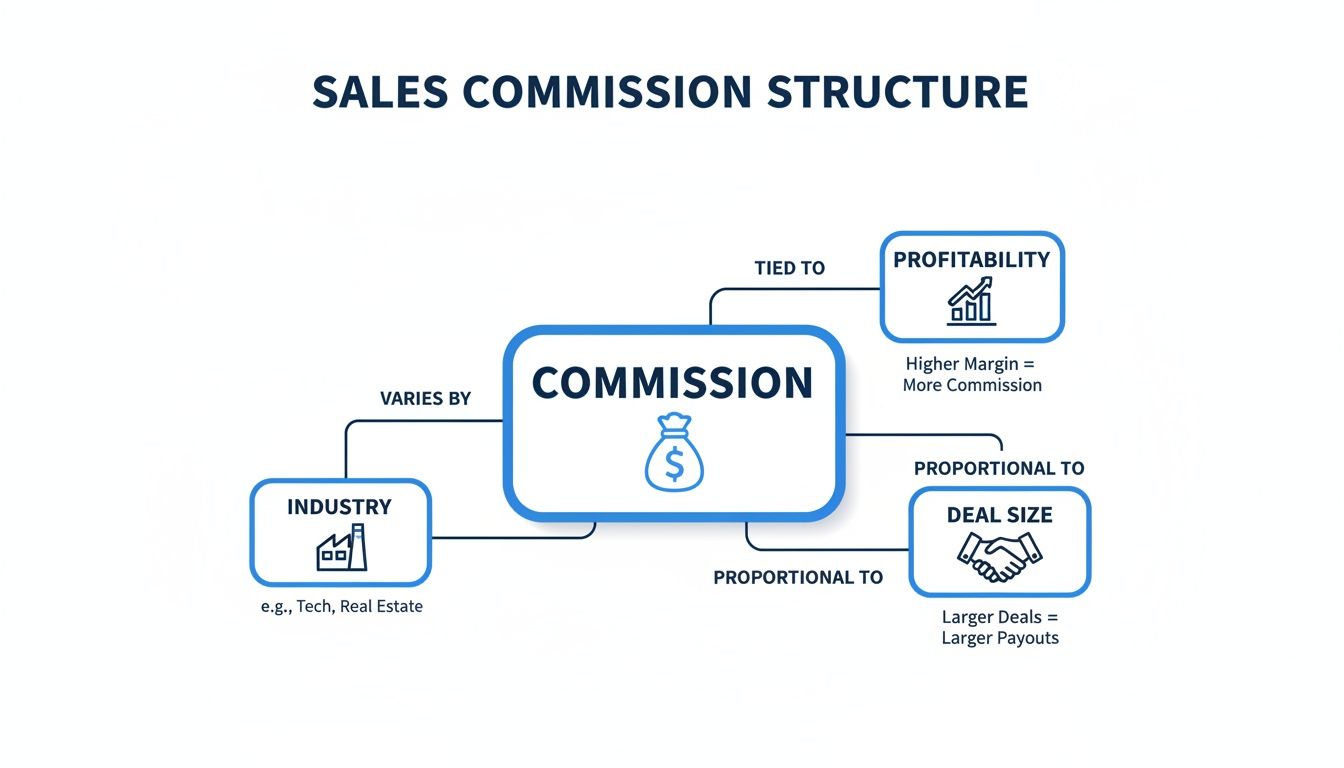

This visual breaks down how key business factors—like your industry, profitability targets, and average deal size—all feed directly into your commission strategy.

As you can see, there’s no "one-size-fits-all" answer. The ideal structure is a careful balance of these core elements, tailored to your specific goals.

Straight Commission: The High-Risk, High-Reward Model

The straight commission (or commission-only) model is as simple and aggressive as it gets. Salespeople earn a percentage of the revenue from the deals they close, and that’s it—no base salary. This model offers the highest potential earnings, but it also carries the most risk for the employee.

For example, a real estate agent working on a 100% commission basis might earn a 3% commission on a $500,000 home sale, pocketing $15,000. But if they hit a slow month and close zero deals, their income is zero. It's a structure you often see in industries with big-ticket items and roles that demand a highly independent, entrepreneurial spirit.

Salary Plus Commission: The Balanced Approach

By far the most common model is salary plus commission. It’s the trusty hybrid that gives salespeople the stability of a fixed base salary, topped up with commission earnings for hitting their performance goals. This approach dials down the risk for the employee while keeping a strong incentive to sell effectively.

A typical B2B software salesperson, for instance, might have a $60,000 base salary and earn an 8% commission on all deals. This balance makes it an incredibly popular and sustainable structure for most sales roles.

This blended model is often seen as the best of both worlds. It gives sales reps the security of a steady paycheck while preserving the powerful motivation that comes from performance-based pay. It aligns individual drive with company revenue goals without creating a cutthroat, all-or-nothing environment.

Tiered Commission: Rewarding Top Performers

A tiered commission structure is designed to light a fire under your sales team. It supercharges motivation by increasing the commission percentage as a salesperson meets—and then blows past—their sales targets. This model is perfect for encouraging reps to always push for that next deal, even after they've hit their quota.

Imagine a SaaS Account Executive with a quarterly quota of $100,000. Their plan might look like this:

- Tier 1: Earn 8% on all sales up to $100,000.

- Tier 2: The rate jumps to 10% for sales between $100,001 and $150,000.

- Tier 3: Anything above $150,000 earns an impressive 12%.

If they close $160,000 in a quarter, their commission isn’t a flat rate. It gets calculated tier by tier, massively rewarding their exceptional performance with a much bigger payout. For those looking to build out their own plans, exploring different commission structure templates can provide a fantastic starting point.

Gross Margin Commission: Prioritizing Profitability

Sometimes, top-line revenue isn't the most important metric; profit is. The gross margin commission model calculates earnings based on the profitability of a deal, not just its total sales price. This is a brilliant way to incentivize salespeople to hold the line on pricing, avoid heavy discounting, and focus on selling high-margin products.

For example, a rep might sell a $20,000 product with a gross margin of $8,000. Instead of getting paid on the full $20,000, they earn a percentage of the $8,000 profit. This ensures they’re always prioritizing deals that are truly healthy for the business's bottom line.

Recurring Commission: For Subscription Success

In subscription-based businesses like SaaS, keeping customers is just as critical as signing them up in the first place. Recurring commission rewards salespeople for the long-term value of a customer, not just the initial win.

They earn a commission on the initial sale and continue to earn on renewals, often for the first year or even longer. This structure directly motivates reps to find and close high-quality customers who are likely to stick around, perfectly aligning sales incentives with the business goal of reducing churn.

How Industry and Role Shape Commission Rates

Ever wonder why a real estate agent can earn a massive commission on a single sale, while a retail associate gets a tiny slice of dozens of smaller transactions? It’s not random. Sales commission percentages are carefully tuned to the economics of a specific industry and the actual job someone does within it.

Think about it this way: selling a complex, high-margin enterprise software package with a year-long sales cycle is a completely different ballgame than selling a t-shirt. The first requires deep expertise, months of relationship-building, and a ton of effort, which naturally commands a bigger reward. The second is all about volume and efficiency, so the commission per item is much lower.

The underlying principle is simple: high-margin products and long, complex sales cycles almost always justify higher commission percentages. Keeping this context in mind is crucial when you start benchmarking your own rates against the wider world.

A Snapshot of Commission Rates Across Key Industries

What’s considered a generous commission in one field might be laughably low in another. Industry norms give you a powerful baseline for setting expectations. Here’s a quick look at how rates typically stack up.

- SaaS (Software-as-a-Service): Often seen as the modern benchmark, SaaS reps usually earn 8-12% of the Annual Contract Value (ACV) on a new deal. This model laser-focuses them on securing long-term, recurring revenue.

- Real Estate: In this high-ticket world, commissions typically fall between 2-6% of the property’s final sale price. That percentage is then split between the buyer's and seller's agents and their brokers.

- Insurance: This sector is a bit more varied. A new policy sale can command a huge commission (sometimes up to 100% of the first year's premium), while renewals earn a much smaller, recurring percentage year after year.

These differences reveal a clear pattern where high-value sectors consistently offer higher rates. While retail and manufacturing commissions often stick around 1-5%, industries like SaaS and financial services can easily reach 10-20% of a sale's value. For a deeper dive, you can explore more about how industry benchmarks vary on CaptivateIQ.

How Different Sales Roles Earn Different Commissions

Just as industries have their own standards, so do the different roles within a single sales team. An organization is made up of specialists, and their pay reflects their unique contribution to closing a deal. You wouldn't pay a scout and a star striker the same way in soccer, and the same logic holds true in sales.

Let's break down two common roles to see why their commission structures are worlds apart.

The Sales Development Representative (SDR)

- Primary Focus: Generating and qualifying leads. SDRs are on the front lines, tasked with booking meetings and teeing up qualified opportunities for the closers.

- Compensation: Their commission is smaller and tied to activity, not the final sale. It’s often a flat dollar amount for each qualified appointment they set or opportunity they create.

The Account Executive (AE)

- Primary Focus: Closing the deal. AEs take the warm leads from SDRs and steer them through the entire sales cycle, from the demo and negotiation all the way to the final signature.

- Compensation: Their earnings are directly tied to the revenue they bring in. They get the main, larger commission percentage based on the total value of the deals they close.

This division of labor and pay is entirely strategic. It lets each person specialize and master one part of the sales funnel, creating a far more efficient pipeline. The SDR gets rewarded for creating opportunities, and the AE gets rewarded for turning those opportunities into cold, hard cash.

How to Calculate Sales Commissions: Putting It Into Practice

Talking about sales commission percentages is one thing, but seeing how they translate into actual dollars and cents is where it all starts to click. Let's move from theory to reality and walk through how to calculate commissions for a few different structures. The math itself isn't complicated, but you'll quickly see how each model is built to reward specific sales behaviors.

The most basic formula is your starting point: Commission = Sale Amount x Commission Percentage. But things get much more interesting—and strategic—when we apply this to tiered, gross margin, and recurring models.

If you want a deeper dive into the fundamentals first, our guide on how to calculate commission on sales is a great resource.

Let's break down three distinct scenarios below to show you exactly how a rep's earnings are calculated in each case.

Example 1: The Tiered Commission Accelerator

Tiered commissions are all about rewarding overperformance. Think of it as a bonus round that unlocks as you hit higher sales targets. Let’s imagine Sarah, a SaaS Account Executive with a quarterly quota of $75,000. Her plan is built to accelerate her earnings the further she gets past her goal.

Here’s what her tiered structure looks like:

- Tier 1: 8% on all sales up to her $75,000 quota.

- Tier 2: 10% on the next chunk of sales, from $75,001 to $100,000.

- Tier 3: 12% on every dollar she brings in above $100,000.

Sarah absolutely crushes her quarter and closes $120,000 in new business. Instead of getting a single flat rate, her commission is calculated piece by piece for each tier she hits.

- Tier 1 Calculation: $75,000 x 8% = $6,000

- Tier 2 Calculation: ($100,000 - $75,000) x 10% = $25,000 x 10% = $2,500

- Tier 3 Calculation: ($120,000 - $100,000) x 12% = $20,000 x 12% = $2,400

Sarah’s Total Commission: $6,000 + $2,500 + $2,400 = $10,900

You can see how this model motivated Sarah to not just hit her number but to blow past it. The further she went, the more valuable each dollar of sales became.

Example 2: The Gross Margin Commission for Profitability

Now, let's switch gears and look at a scenario that prioritizes profit, not just top-line revenue. David sells B2B hardware, and his company wants to stop reps from handing out heavy discounts just to close deals. So, his commission is tied directly to the gross margin of each sale.

David closes a big deal for a new server system with a total sale price of $50,000. The actual cost of that hardware (the Cost of Goods Sold, or COGS) was $30,000. His commission rate is a healthy 25% of the gross margin.

- First, Calculate the Gross Margin: Sale Price - COGS = Gross Margin $50,000 - $30,000 = $20,000 Gross Margin

- Next, Calculate the Commission: Gross Margin x Commission Rate $20,000 x 25% = $5,000

If David had caved and discounted the sale price down to $45,000, his commission would have dropped to just $3,750. This structure gives him a very powerful incentive to protect the company's profitability on every single deal.

Example 3: The Recurring Commission for Long-Term Value

Finally, let’s look at a recurring commission model, which is the lifeblood of most subscription-based businesses. Maria is an Account Executive at a project management SaaS company. Her plan pays her 10% of the first year's contract value, and it's paid out to her monthly as the client pays.

She signs a new client on a $1,200 per month plan. That comes out to $14,400 in Annual Contract Value (ACV).

- Total First-Year Commission: $14,400 x 10% = $1,440

- Monthly Commission Payout: $1,440 / 12 months = $120 per month

For the next year, Maria will get a check for $120 every month from this one deal, as long as that customer sticks around. This model encourages her to find and sign high-quality clients who are a good fit and less likely to churn, building a stable and predictable revenue base for the company.

For anyone managing these kinds of payouts over time, knowing how to calculate percentages in Excel can be a huge time-saver for tracking everything accurately.

How to Design a Fair and Motivating Commission Plan

Building a commission plan is more architecture than arithmetic. It’s not just about picking a few percentages; it’s about designing a system that steers your sales team toward the right behaviors. A great plan acts as a roadmap, motivating reps to chase the goals that matter most, whether that’s cracking a new market or maximizing profit on every deal.

This is your chance to perfectly align individual incentives with your company's bigger vision. The end goal is a plan that’s fair, motivating, and so simple everyone just gets it. When your team trusts the system, they can pour all their energy into what they do best: selling.

Align Your Plan With Core Business Goals

Before you even touch a calculator, ask one crucial question: What behavior do we actually want to drive? The answer should be the bedrock of your entire commission structure. Different goals demand completely different blueprints.

For instance, if your number one priority is rapid market expansion, you’ll want a plan that heavily rewards landing new logos. But if profitability is the name of the game, a gross margin commission structure that discourages deep discounts makes a lot more sense.

Your commission plan should be a direct reflection of your business strategy. This tight alignment ensures that as your salespeople work to max out their own paychecks, they're simultaneously pushing the company exactly where it needs to go. It creates a powerful, self-sustaining engine for growth.

Keep It Simple and Transparent

Complexity is the enemy of motivation. If your sales reps need a spreadsheet and a math degree to figure out their paycheck, your plan is broken. The best, most effective commission structures are simple enough for a rep to calculate their potential earnings on the back of a napkin.

This kind of simplicity builds trust and clarity. When reps understand precisely how their effort translates into reward, they feel more confident and driven. Transparency cuts through the confusion, prevents arguments over payouts, and helps create a healthier, more productive sales culture.

A commission plan should be a source of motivation, not a mystery. When the rules are clear and the math is straightforward, reps can focus 100% of their energy on hitting their targets, knowing exactly what they’ll earn when they succeed.

Set Challenging Yet Achievable Quotas

A sales quota is the performance benchmark that unlocks commissions, and getting it right is a delicate balancing act. Set it too low, and you're leaving money on the table. Set it too high, and you risk demoralizing your entire team. The sweet spot is a target that feels like a genuine stretch but is still seen as achievable.

A good quota should push your reps to perform at their best. As a rule of thumb, around 60-70% of your sales team should be able to hit their quota in any given period. If that number is way lower, your targets are probably unrealistic. If it's much higher, they aren't ambitious enough. To keep your team's pipeline full of opportunities, consider automating your sales pipeline.

Use Modern Tools for Automation and Visibility

Tracking commissions by hand is a recipe for errors, disputes, and countless wasted hours. In today's sales environment, using modern software isn't a luxury—it’s a necessity for running an efficient and fair commission program.

Tools like LinkJolt are built to handle this complexity for you. They deliver the key features that make all the difference:

- Automated Calculations: Eliminate human error and ensure commissions are calculated accurately and instantly based on your plan’s rules.

- Real-Time Dashboards: Give your reps a live, transparent view of their performance and potential earnings, keeping them fired up throughout the month.

- Effortless Payouts: Streamline the entire payment process, making sure your team gets paid correctly and on time, every single time.

By automating the administrative side of things, you free up both managers and reps to focus on the high-value activities that actually drive revenue. This creates a transparent, trustworthy system that keeps your team happy and motivated.

Common Questions About Sales Commission

Even with a perfect-looking commission plan on paper, the real world always has questions. It’s one thing to map out structures in theory, but it’s another to handle the day-to-day details that pop up for your sales reps and managers. This is where you build clarity and confidence.

Think of this section as your quick-reference guide for those practical moments. We're tackling the most common questions about sales commissions with direct, no-fluff answers to help you navigate the important details that come with performance-based pay.

What Is Considered a Good Sales Commission Percentage?

This is the million-dollar question, isn't it? The most honest answer is: it depends entirely on context. A "good" commission in one industry could be a deal-breaker in another. That said, a solid benchmark for many B2B sectors, especially in SaaS, usually falls between 8% and 12% of a deal's value.

But a number is just a number without the story behind it. Here are the factors that really define a "good" rate:

- Industry Standards: A 5% commission in real estate would be shockingly low, but in a high-volume retail setting, it might be competitive.

- Product Margin: High-profit products can and should support higher commission percentages. If a sale brings in a healthy profit for the business, the rep’s cut should reflect that.

- Sales Cycle Complexity: A deal that takes six months of intense, multi-stakeholder negotiation to close obviously deserves a much higher commission rate than a quick, transactional sale that closes in a week.

Ultimately, a good commission is one that’s competitive enough to attract and keep top talent while still being sustainable for the business. It needs to feel fair to the salesperson and be a smart investment for the company.

How Often Are Commissions Typically Paid Out?

While the payout schedule can vary, the most common frequency by far is monthly. This rhythm gives salespeople a regular and predictable cash flow, which is huge for morale and financial stability—especially for those on a salary-plus-commission plan.

Of course, other schedules exist to fit different business models:

- Quarterly Payouts: These are pretty common in enterprise sales where deals are larger, more complex, and less frequent. Paying out quarterly allows for a more comprehensive review of performance against bigger targets.

- Upon Closing or Payment: In some high-ticket industries like real estate or custom manufacturing, the commission is often paid out only after the deal is officially signed and the client's payment has hit the company’s bank account.

The best practice here is simple: be transparent and be consistent. Whatever schedule you choose, make sure it’s spelled out clearly in the commission agreement to head off any confusion or disputes down the line.

Are Sales Commissions Taxed Differently Than Salary?

Yes, sales commissions are absolutely taxed, but the way it's handled can feel a little different from a regular salary. While both are considered income, the IRS often views commissions as supplemental wages, which means they can be taxed at a different rate.

Employers generally have two main ways to withhold taxes on this extra income:

- The Percentage Method: This is the simple, straightforward approach. The employer withholds a flat 22% federal tax right off the top of the commission payment.

- The Aggregate Method: Here, the employer lumps the commission payment in with the employee's regular salary for that pay period. They then calculate the withholding based on the employee's W-4 information, which often results in a higher withholding rate for that specific paycheck.

It's a good heads-up for sales professionals, as a big commission check might have more tax withheld than they expect. Chatting with a tax professional is always a smart move to plan for tax liabilities effectively.

Key Takeaway: While commissions feel like a modern tool for motivating sales teams, their roots go surprisingly deep. The idea of earning a slice of a deal isn't some new invention—it's an age-old practice that has driven commerce for centuries.

If you trace the history of sales commissions, you’ll find it goes all the way back to the traveling merchants on the Silk Road in the Middle Ages. They acted as intermediaries, taking a cut from risky, negotiated deals—laying the groundwork for the structured percentages we use today. This "bet on yourself" ethos is still alive and well, having evolved into the hybrid salary-plus-commission models we see in modern sales. For instance, while some roles have a higher base salary, many Account Executives lean toward a 50/50 split between their base and variable pay. The long history of these structures provides fascinating context, and you can learn more about how salespeople have always bet on themselves over at The Quota.

Ready to eliminate commission headaches and motivate your partners? With LinkJolt, you can automate your entire affiliate and referral program, from tracking to payouts, with zero transaction fees. Get started with LinkJolt today and build a commission plan that drives real growth.

Watch Demo (2 min)

Trusted by 300+ SaaS companies

Start Your Affiliate Program Today

Get 30% off your first 3 months with code LINKJOLT30

✓ 3-day free trial

✓ Cancel anytime