Affiliate Marketing Commission Rates: Maximize Your Earnings

Affiliate Marketing Commission Rates: Maximize Your Earnings

Ollie Efez

September 14, 2025•20 min read

Affiliate marketing commission rates are essentially your cut of the pie. It's the percentage or flat fee you get paid when someone you refer takes a specific action, like buying a product, signing up for a trial, or even just clicking a link.

These rates can swing wildly. You might see rates as low as 1-10% for physical products on big e-commerce sites. On the flip side, digital products and software subscriptions can offer huge payouts, sometimes 70% or more.

What Are Affiliate Marketing Commission Rates

Think of an affiliate marketer as a digital-age salesperson working on commission. When they send a paying customer to a business, they earn a fee. That fee is the affiliate marketing commission rate—it’s the financial fuel that keeps the whole affiliate world running.

This rate isn't just a number pulled out of a hat. It’s a carefully calculated figure that needs to strike a perfect balance. For businesses, the rate has to be juicy enough to attract and motivate talented affiliates, but not so high that it eats away all their profit on the sale.

The Core Concept of Commission

At its core, a commission is a reward for performance. A company isn't just paying for ad clicks or impressions; they're only paying when they get a real result. This makes it a super-efficient marketing model, directly connecting what they spend to what they earn. For affiliates, it means their income is tied directly to how effective their recommendations are.

This setup creates a win-win relationship:

- For the Business: They get access to a massive, motivated sales team without the costs of hiring one. The risk is incredibly low because they only pay for actual sales.

- For the Affiliate: They can earn money from their content and influence by promoting products they genuinely like. It’s a way to turn their expertise into a real income stream.

The real magic of this model is how it aligns everyone's goals. The company wants more sales, and the affiliate wants to earn a commission. When one succeeds, so does the other. It's a true partnership built for growth.

Why Understanding Rates Is Crucial

Getting a handle on commission rates is non-negotiable for both sides. For affiliates, knowing the typical rates helps you pick niches and programs that are actually worth your time. Earning 5% on a $20 book is a completely different game than earning a 30% recurring commission on a $99/month software subscription. The percentage alone never tells the full story. For a more detailed breakdown, check out the definition of commission in our glossary.

For businesses, setting the right commission rate is one of the most important decisions you'll make when launching an affiliate program. Go too low, and you won't attract any top-tier affiliates. Go too high, and you might kill your profit margins. It's a decision that requires knowing your industry benchmarks, product costs, and the long-term value of a customer. Ultimately, the commission rate is the main dial you can turn to make your program competitive and successful.

The Most Common Affiliate Commission Models

Knowing what a commission is is just the start. The real question is how you'll actually get paid. Companies don't just pull percentages out of a hat; they use specific payment models that line up with what they want to achieve.

The structure they choose tells you everything about what they value most. Is it a final sale? A potential customer? Or just getting more eyes on their website? Understanding these models helps you forecast what you could realistically earn and pick programs that are a great fit for your audience.

Pay-Per-Sale (PPS)

This is the bread and butter of affiliate marketing. With Pay-Per-Sale, you earn a commission only after your referral leads to someone actually buying something. It’s the ultimate performance-based deal because the company doesn't pay a dime until they’ve made a sale.

It's no surprise that PPS is so popular—it ties marketing spend directly to revenue. Companies selling things like software subscriptions, electronics, or other high-ticket items almost always go this route. It’s a clean, immediate return on their investment.

For instance, a software company might offer a 30% commission on its $100/month plan. You make $30, but only after a customer signs up and pays. This makes the partnership low-risk for them and potentially very rewarding for you. This model is a cornerstone of so many programs, and you can get a deeper look at the possibilities in our guide on choosing an affiliate commission structure.

Pay-Per-Lead (PPL)

With Pay-Per-Lead, you get paid when your referral completes a specific action that turns them into a "lead." This isn’t a sale. Instead, it might be filling out a contact form, signing up for a free trial, or subscribing to a newsletter.

PPL is the go-to model for businesses with a longer sales process. Think about insurance agencies, home contractors, or high-end B2B services. Their main goal is to fill their sales pipeline with qualified people, and they’re happy to pay for each solid prospect you send their way.

- Example: A local marketing agency might pay $25 for every business owner who fills out their "request a quote" form.

- Another Example: A software company could offer $5 for every user who signs up for a 14-day free trial, even if that person never buys.

Pay-Per-Click (PPC)

The Pay-Per-Click model is less common in affiliate marketing these days, but it still has its place. Here, you earn a small fee every single time someone clicks your affiliate link. It doesn't matter if they buy anything or sign up—the click is what counts.

Because it pays for traffic instead of a conversion, PPC commissions are tiny, often just a few cents per click. This structure is more common in massive ad networks than in a brand's direct affiliate program. It can also be a magnet for fraud, so companies that use it are usually very careful.

The core idea behind choosing a model is all about risk. PPS puts the risk on the affiliate (no sale, no pay), while PPC puts it on the merchant (paying for clicks that might go nowhere). PPL splits the difference.

Hybrid and Tiered Models

The affiliate world is getting more creative. Many programs now blend these basic models to build more motivating and flexible payout structures. In fact, things have gotten pretty diverse. Research shows nearly half of companies (48.9%) pay a flat rate per action, while 42.4% stick with percentage-based commissions. Others are adopting more complex tiered systems to reward their best partners.

These more sophisticated setups often look like this:

- Tiered Commissions: This is all about rewarding top performers. For example, an affiliate might earn 20% on their first 10 sales of the month, but that rate jumps to 25% for sales 11-50, and maybe even 30% for anything beyond that.

- Hybrid PPL + PPS: A program might offer a little something for the lead (say, $2 for a trial signup) plus a much larger commission (25% of the first payment) if that lead eventually becomes a paying customer.

These advanced models are designed to keep affiliates motivated and pushing for better results. It creates a powerful win-win where the business and its top partners can really grow together.

What Are Typical Commission Rates Across Different Industries?

When you step into the world of affiliate marketing, you'll quickly notice one thing: not all commission rates are created equal. What's considered a fantastic rate in one niche might be laughably low in another. Getting a handle on these differences is crucial, whether you're an affiliate hunting for a profitable space or a brand trying to set a competitive rate for your own program.

Think of it this way: selling a digital software subscription is a world away from selling a t-shirt. The software costs next to nothing to duplicate, giving it a massive profit margin. The t-shirt, on the other hand, has real costs—materials, manufacturing, shipping—that eat into the profit. This simple economic reality is the main reason affiliate marketing commission rates are all over the map.

Software And Digital Products: The High-Margin Leaders

If you're looking for the most eye-popping commission rates, the digital world is where it's at. It all comes down to scalability and profit.

Software as a Service (SaaS) and digital goods like online courses or e-books are often the heavy hitters for affiliates. Since you can sell them over and over with almost no extra cost, companies can afford to be much more generous with their revenue sharing. It's not uncommon to see rates here that would be completely unsustainable for physical products.

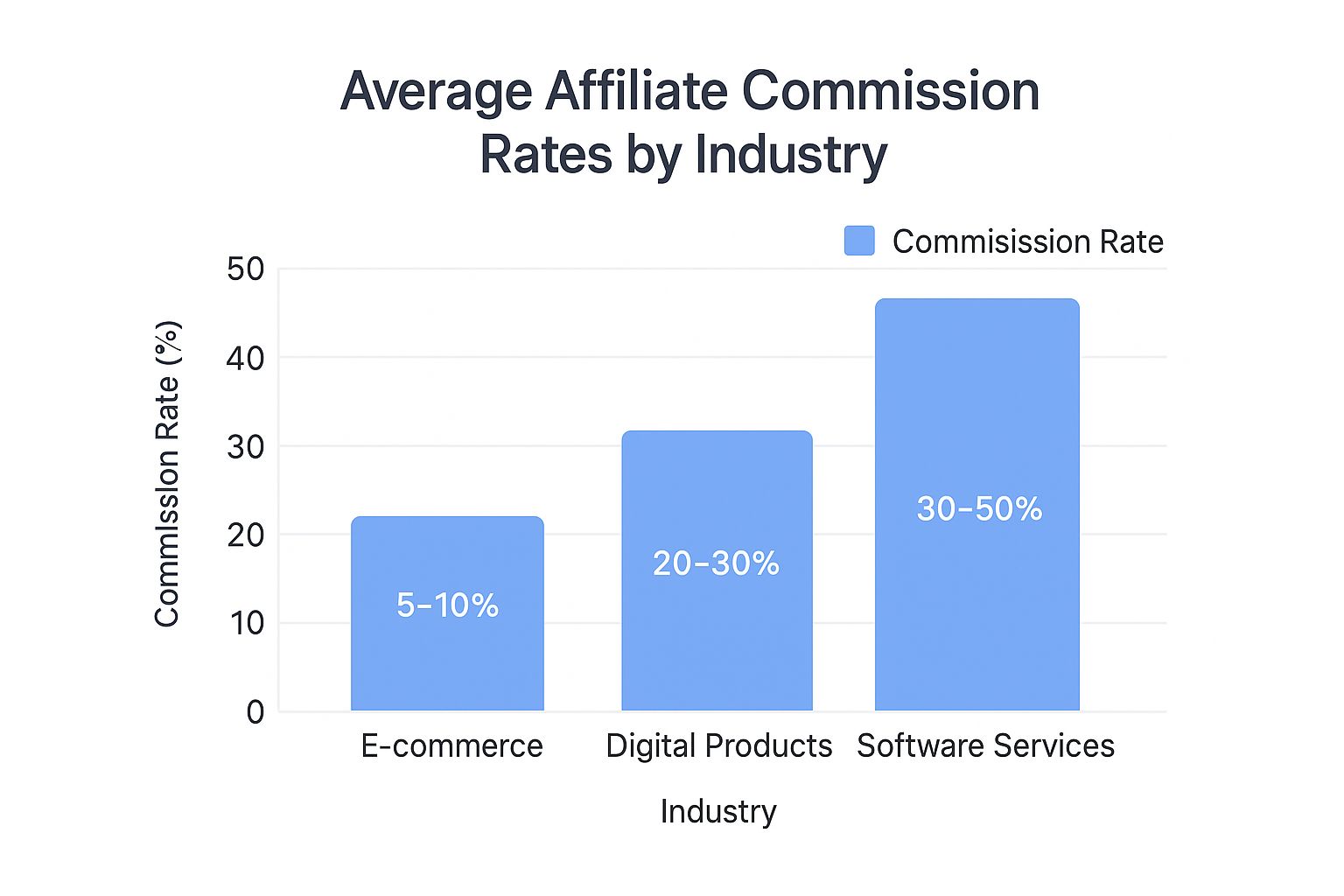

This visual breakdown shows just how different the playing field is.

As you can see, the gap is huge. Software services can offer commission rates five times higher than what you’d typically find in an e-commerce program.

The numbers really speak for themselves. The SaaS industry leads the pack with rates from 20% to a staggering 70%. The finance niche is also quite strong, often sitting between 35% and 40%, while the e-learning space offers a solid 15% to 30%. If you want to dive deeper into the data, you can learn more about these affiliate marketing statistics and see how the benchmarks shake out.

Let's take a closer look at what you can expect in some of the most popular affiliate niches.

Typical Affiliate Commission Rates by Industry

This table gives you a snapshot of the commission rate landscape. It highlights the average percentages you'll encounter across various sectors, helping you see the earning potential in each.

Remember, these are just benchmarks. A program's structure, brand reputation, and conversion rates are just as important as the number itself.E-commerce And Physical Goods: A Game Of Volume

Now for the other side of the coin: e-commerce and physical products. Here, the math is completely different.

With tangible items, you have to account for the cost of making, storing, and shipping everything. Those costs mean tighter profit margins, which naturally leads to lower affiliate commissions. For big retailers, a rate somewhere between 3% and 10% is pretty standard. The name of the game here is volume—you need to drive a lot of sales to make a good income.

Key Takeaway: Don't get fixated on the percentage alone. A lower commission on a high-ticket item or a product that converts like crazy can easily outperform a high commission on something nobody buys.

Why The Big Differences?

Profit margin is the biggest piece of the puzzle, but a few other key factors explain why commission rates vary so much. Understanding these will help you see the logic behind the numbers.

1. Customer Lifetime Value (LTV)

Companies that sell subscriptions love affiliates. Why? Because a single referral can bring in cash flow for months or even years. This high LTV means they can afford to offer juicy recurring commissions. A SaaS company with a $100/month plan and a 30% recurring rate will pay an affiliate $30 every single month that customer sticks around.

2. Average Order Value (AOV)

Promoting luxury goods or expensive electronics can be incredibly profitable, even with a seemingly low commission rate. A 10% commission on a $2,000 laptop is a $200 payout from one sale. That's a win.

3. Industry Competition

In cutthroat markets like web hosting or VPN services, companies battle for affiliates. They'll often use aggressive, high-paying commission structures to attract top talent. They know a superstar promoter can make a real dent in their market share, and they're willing to pay a premium for that power.

Ultimately, picking the right niche is a balancing act. Those high percentages in the software world are tempting, but true success comes from matching the right products with an audience that genuinely needs them.

Key Factors That Influence Commission Rates

Ever look at two similar affiliate programs and wonder why one pays out a massive 40% commission while the other barely offers 10%? Those numbers aren't just pulled out of a hat. Behind every affiliate marketing commission rate is a careful business calculation, a balancing act between what a company can afford to pay and what it needs to offer to attract great partners.

For affiliates, getting a grip on these factors means you can spot a genuinely good program and not just get distracted by a flashy percentage. For merchants, it's about setting up a commission structure that's both competitive and sustainable.

Let's pull back the curtain and look at what really goes into setting these rates.

Product Profit Margins

This is the big one. At its core, the commission rate is dictated by the product's profit margin. Think of it like a pizza: the bigger the pizza (the profit), the bigger the slice the company can afford to give you. This simple concept explains the huge difference you see between digital and physical product commissions.

Digital products—like an online course or a piece of software—have almost no cost to replicate. Once the initial development is done, the profit margin on each sale is incredibly high. On the flip side, physical products like sneakers or headphones have real costs tied to every single unit: materials, manufacturing, shipping, and storage. All of that eats into the profit pizza.

- Digital Goods: High margins fuel generous commissions, often in the 20-70% range.

- Physical Goods: Lower margins naturally lead to smaller commissions, typically between 1-10%.

Customer Lifetime Value (LTV)

How much is one customer worth to a company over time? That's their Customer Lifetime Value (LTV), and it’s a total game-changer, especially for SaaS companies and subscription services. A single referral isn't just a one-time sale; it can be a source of revenue for months, or even years.

When a company knows its LTV is high, it can justify paying a much larger commission upfront or offering recurring commissions. A one-off purchase of a toaster has a clear, fixed value. But a subscription to a $50/month software tool could easily be worth $600 over the first year. In that case, offering a 30% recurring commission ($15/month) is a brilliant investment for the company.

A higher Customer Lifetime Value gives merchants the confidence to offer more attractive, often recurring, commission rates because they know each successful referral will deliver long-term, predictable revenue.

This is exactly why seasoned affiliates love subscription programs. They offer a path to building a stable, compounding income instead of constantly chasing the next one-time sale.

Brand Recognition and Conversion Rates

Simply put, how easy is the product to sell? An affiliate's job is a lot easier when they’re promoting a household name with a finely-tuned, high-converting sales process. A giant like Amazon knows its brand power and optimized checkout flow will do most of the heavy lifting.

Because of this built-in advantage, established brands can get away with offering lower commission rates. They know affiliates are more likely to make a sale—and will earn their money through sheer volume. On the other hand, a new or unknown brand might offer a much higher commission rate as an incentive for affiliates to take a chance on them and help get their name out there.

Cookie Duration Explained

The "cookie duration," sometimes called the referral window, is the period during which you get credit for a sale after someone clicks your link. This little detail is often overlooked, but it can be just as important as the commission percentage itself.

Let's compare two hypothetical programs:

- Program A: Offers a huge 40% commission, but the cookie only lasts for 24 hours.

- Program B: Offers a more modest 25% commission, but with a generous 90-day cookie.

Program A sounds amazing at first glance. But what if it's for an expensive product that people take weeks to decide on? That 24-hour cookie becomes almost worthless. Program B gives your referral three full months to think it over, do more research, and eventually come back to buy—and you still get paid. A long cookie duration is a crucial safety net for your hard work.

How to Maximize Your Affiliate Commission Earnings

https://www.youtube.com/embed/LZNvFx9zqjI

Knowing how affiliate marketing commission rates are decided is one thing. Actually making them grow is the real game. Just grabbing some links and tossing them into your content is a fine start, but it’s not what separates the pros from the amateurs.

The top earners don't just work harder; they work smarter. It's all about being strategic—picking the right products, building a real connection with your audience and affiliate managers, and dialing in your content until it converts like crazy. With a few proven tactics, you can turn a side hustle into a serious revenue stream without needing a tidal wave of new traffic.

Focus on High-Ticket and Recurring Offers

The quickest way to see a jump in your earnings is to promote offers that give you more bang for your buck. Let's be honest, not all affiliate products are created equal. Where you send your audience matters. A lot.

Think about it like this: selling ten $50 products with a 10% commission gets you $50. But selling just one $1,000 product at that same 10% rate? That's $100. The work to create the content and convince someone to buy is often pretty similar, but the payout is worlds apart.

To make this happen, zero in on these two types of offers:

- High-Ticket Items: These are the premium products and services with a hefty price tag—think high-end software, luxury travel, or specialized professional gear. A single sale can bring in what would normally take dozens of smaller sales to earn.

- Recurring Commissions: This is the secret to building stable, predictable income, especially in the SaaS and subscription world. You get paid not just on the first sale, but for every single month that customer sticks around. You do the work once and get paid over and over.

Negotiate for a Higher Commission Rate

Here's something a lot of affiliates don't realize: commission rates aren't always carved in stone. Once you've proven you can send a steady stream of quality traffic and sales, you've earned some serious leverage. Affiliate managers want to keep their top performers happy.

So, don't be afraid to ask for a raise. Just make sure you do it professionally.

The key to a successful negotiation is data. Vague requests are easily dismissed. Come prepared with clear evidence of your performance, such as your conversion rates, sales volume, and the quality of traffic you generate.

Before you even think about sending that email, get your numbers in order. Show them precisely how you're outperforming the average affiliate. A simple, polite email that highlights your success and asks to be bumped to a higher commission tier can work wonders. Great partnerships are a two-way street, and good companies are more than willing to reward people who deliver real results.

Optimize Your Conversion Funnel

Getting traffic to your site is only half the job. Turning that traffic into sales is where the money is actually made. Constantly tweaking and improving your conversion rate is one of the most powerful things you can do. Even a tiny bump from a 2% to a 3% conversion rate is a massive 50% increase in your earnings.

Start by walking through your entire promotional process, from the very first click to the final purchase. Look for any friction points or places where you could be losing people.

Here are a few actionable things you can do right now:

- Strengthen Your Calls-to-Action (CTAs): Are your "buy now" buttons clear, compelling, and easy to spot? Try experimenting with different words, colors, and placements to see what your audience responds to.

- Build Trust with Authenticity: People buy from people they trust. Ditch the overly salesy hype and focus on genuine reviews, personal stories, and honest case studies. Be a real resource, not just a billboard.

- Use Strategic Tools: Make it easy for your readers to make a decision. Things like comparison tables, slick product boxes, and bold "buy now" buttons guide them toward the sale. If you want to see how different numbers play out, use a free affiliate commission calculator to project your potential income.

By consistently refining your strategy and focusing on these high-impact areas, you can move from just earning commissions to truly maximizing what's possible with affiliate marketing.

Frequently Asked Questions

When you're digging into affiliate marketing, commission rates are often where the biggest questions pop up. Let's tackle some of the most common ones I hear from both seasoned pros and newcomers alike.

What Is a Good Affiliate Marketing Commission Rate?

There's no magic number here. A "good" commission rate is all about context—what’s fantastic in one niche might be barely worth your time in another. You have to look past the percentage and see the full picture.

For physical products on big e-commerce sites, a 3-10% commission is pretty standard. That might not sound like much, but if you're moving a lot of product, it adds up fast. On the flip side, digital goods like software or online courses can offer huge rates, often from 20% all the way up to 70%, simply because there are no manufacturing or shipping costs eating into their margins.

The real secret is to weigh the rate against the product's price and how well it converts. A 10% commission on a $2,000 laptop nets you $200. That’s a whole lot better than a 50% commission on a $10 e-book that only makes you $5.

So, when you're sizing up a program, always look at these three things together:

- Commission Percentage: The raw number.

- Product Price: How much the item actually costs.

- Conversion Potential: How likely your audience is to click "buy."

The sweet spot is where these three elements align. That’s what makes a commission rate truly "good" for you.

Can I Negotiate for Higher Commission Rates?

Absolutely. In fact, you should! Once you’ve proven you’re a valuable partner, negotiating your rate isn't just possible—it's expected. Many programs have built-in tiers for top performers or are open to custom deals for affiliates who consistently deliver.

But you can't just ask for more money out of the blue. You need to walk in with a strong case backed by solid data. The goal is to prove your worth.

Before you even think about sending that email, get your stats in order:

- Sales Volume: How many sales are you driving every month?

- Conversion Rates: How good are you at turning your traffic into paying customers?

- Traffic Quality: Where does your audience come from, and why are they a perfect match for the brand?

With that data in hand, reach out to your affiliate manager. Don't make it a demand; frame it as a partnership discussion. A simple script could be, "A higher commission would let me reinvest in more paid ads to promote your products." It creates a win-win. They want to keep their best people happy because when you make more money, so do they.

How Do Recurring Commissions Actually Work?

Recurring commissions are the holy grail of affiliate marketing. They’re how you build a stable, predictable income stream instead of constantly chasing the next sale. This model is super common with any subscription-based service, like software (SaaS), membership sites, and online courses.

The idea is simple but powerful. You refer a customer once, and you get paid over and over again. Instead of a one-time payout, you earn a commission every single time that customer's subscription renews.

Here’s a quick example to see it in action:

- You promote a software tool that costs $100 a month.

- The program offers a 20% recurring commission.

- Your referral signs up, and you immediately earn $20.

- But it doesn't stop there. You keep earning another $20 every single month that person stays a customer.

That one referral just earned you $240 over the course of a year. Now, imagine you have dozens or even hundreds of those. You did the work once, but the reward keeps coming in, month after month. It completely changes the game, turning one-off promotions into a real, compounding business asset.

Ready to launch, manage, and scale your own affiliate program without the complexity? LinkJolt provides all the tools you need, from automated payout processing to real-time analytics, with zero transaction fees. Get started with LinkJolt today and see how easy growing your business can be.

Watch Demo (2 min)

Trusted by 300+ SaaS companies

Start Your Affiliate Program Today

Get 30% off your first 3 months with code LINKJOLT30

✓ 3-day free trial

✓ Cancel anytime