What Is Cost Per Acquisition: what is cost per acquisition demystified

What Is Cost Per Acquisition: what is cost per acquisition demystified

Ollie Efez

December 24, 2025•16 min read

Cost Per Acquisition (CPA) is the price you pay to win a single new customer from a specific marketing campaign.

Let's say you spend $1,000 on a Google Ads campaign and it brings in 10 new paying customers. Your CPA for that campaign is a neat $100. It's one of the cleanest ways to measure how well your marketing dollars are working.

What Is Cost Per Acquisition In Simple Terms

Think of CPA as the exact price tag on acquiring a customer through one specific action. While the term might sound a bit academic, it's really just a straightforward metric to see if your marketing budget is actually turning clicks into cash.

It helps you answer a critical question: is this campaign actually making money?

Understanding your CPA is what allows you to confidently double down on the marketing channels that are delivering real results and cut the ones that are just draining your budget. That clarity is the key to smart spending and sustainable growth.

The Core CPA Formula

The basic calculation for Cost Per Acquisition is refreshingly simple. This formula is the bedrock for any deeper analysis or optimization you'll do later on.

Total Marketing Spend / Total Conversions = Cost Per Acquisition (CPA)

To get a number you can trust, you need to be strict about what you count as "spend" and what qualifies as a "conversion." Vague definitions will give you a fuzzy CPA, which can throw your entire strategy off course.

While there are broader metrics—and many resources offer a general Customer Acquisition Cost (CAC) Explained—CPA is hyper-focused on the results of a single campaign. For a deeper comparison, check out our complete guide on customer acquisition cost calculation.

Breaking Down The CPA Formula

Let’s quickly break down the two parts of the formula so we’re all on the same page.

Breaking Down The CPA Formula

Getting these two inputs right is the first step to truly understanding your CPA. It's not just about the ad budget; it's about accounting for every dollar that went into getting that customer to act. This disciplined approach gives you a true picture of your campaign's performance.How To Calculate Your CPA With Real Examples

Knowing the formula is one thing, but seeing it in action with real numbers is what makes the concept truly click. Let's walk through a quick, practical example to show just how straightforward it is to calculate CPA.

Imagine a SaaS company called "ProjectFlow" decides to run a targeted Facebook ad campaign. Their goal is simple: get more people to sign up for a free trial. Over one month, they spend a total of $3,000 on this campaign.

By the end of the month, their efforts have paid off, generating 150 new free trial users. Now, they can plug those numbers directly into the CPA formula.

$3,000 (Total Campaign Cost) / 150 (Total Sign-ups) = $20 CPA

Just like that, ProjectFlow knows they paid exactly $20 for every single user who signed up for a free trial through that Facebook campaign. This simple calculation gives them a hard number to measure the campaign's efficiency.

Distinguishing CPA From Other Key Metrics

Knowing your CPA is a huge step, but it’s crucial not to mix it up with other vital metrics like Customer Acquisition Cost (CAC) and Lifetime Value (LTV). Each one tells a different part of your business’s story, and confusing them can lead to some seriously flawed strategic decisions.

CPA is a tactical metric focused on a specific campaign or channel, while CAC is a broader strategic metric that includes all costs—sales, marketing, salaries—to acquire a paying customer.

For a more streamlined approach, especially when your calculations get more complex, using a dedicated customer acquisition cost calculator can save you a ton of time and help ensure you're accounting for every relevant expense.

Getting these distinctions right is key. While CPA tells you how efficiently you’re driving a single action, CAC and LTV give you the bigger picture of your overall business health and long-term profitability.

CPA vs CAC vs LTV A Quick Comparison

To make the differences crystal clear, here’s a quick table breaking down what each metric measures and where it's most useful. Getting this right is fundamental to building a smart, data-driven marketing strategy.

In the end, think of it like this: CPA provides the granular, day-to-day data you need to tweak your marketing activities. When you track it alongside CAC and LTV, you get a complete view of both your campaign performance and your company's financial stability. This balanced perspective is absolutely essential for sustainable growth.So, What Does a Good CPA Actually Look Like?

Figuring out your Cost Per Acquisition is the easy part. The million-dollar question is knowing whether that number is actually good.

There’s no magic number here. A fantastic CPA for a Shopify store selling t-shirts could spell disaster for a B2B SaaS company. The truth is, benchmarks are all over the map, swinging wildly based on your industry, business model, and the channels you’re using. B2B companies, for example, almost always have higher acquisition costs because of longer sales cycles and more people involved in the final decision.

Industry Benchmarks Are a Decent Starting Point

While your own business metrics are the only ones that truly matter, industry data can give you a useful yardstick to see where you stand. And recent benchmarks show just how much these costs can differ.

In the B2B SaaS world, for example, average customer acquisition costs range from $205 on the low end to $341 at the high end. Dig deeper into specialized sectors, and the gaps get even wider. Biotech firms can spend anywhere from $532 to $855 per customer, while business consulting lands between $410 and $901 thanks to fierce competition. You can dive into more detailed customer acquisition cost averages to see how your numbers stack up.

These figures show why chasing a generic "average" can be so misleading. A much more powerful way to judge your performance is to stop looking outward and start looking inward.

The Only Benchmark That Really Matters: Your LTV Ratio

Forget industry reports for a second. The single most critical benchmark for your CPA is your Customer Lifetime Value (LTV). LTV is the total revenue you can expect to bring in from a single customer over the entire time they do business with you.

A "good" CPA isn't a specific number—it's any cost that allows you to grow profitably and sustainably. The whole game is making sure your LTV is significantly higher than what you paid to get that customer in the door.

A widely accepted rule of thumb in SaaS is to aim for an LTV-to-CPA ratio of at least 3:1. For every dollar you spend to acquire a customer, you should expect to get at least three dollars back over their lifetime.

- If your ratio is 1:1, you're actually losing money on every new customer once you account for the costs of running your business.

- A 3:1 ratio is the sign of a healthy, profitable acquisition model. You're in a good spot.

- A ratio of 4:1 or higher means you've built a powerful growth engine and could probably afford to get more aggressive with your marketing spend.

Ultimately, this internal benchmark is what defines a good CPA for your business. It’s the number that tells you whether you're building a sustainable company or just spinning your wheels.

Proven Strategies to Lower Your Cost Per Acquisition

Knowing your Cost Per Acquisition is a great start, but the real game begins when you start actively pushing that number down. Every dollar you shave off your CPA is a dollar that works harder for your business, stretching your marketing budget and directly boosting your profitability.

The good news? Lowering your CPA doesn't mean you have to burn your entire marketing plan to the ground and start over. More often than not, it comes down to smart, targeted optimizations in a few key areas. Think of it as a series of small tweaks that add up to big savings over time.

Let's move past the theory and get into the practical, repeatable tactics you can start using today to get customers in the door more efficiently.

Refine Your Ad Targeting and Messaging

One of the fastest ways to slash your CPA is to stop paying for clicks from people who will never buy your product. Wasted ad spend on low-intent traffic is the silent killer of marketing budgets and a primary cause of sky-high acquisition costs. The fix is simple in theory but requires discipline: get laser-focused.

Start by diving into the data of your best customers—the ones with high LTV who love your product. What do they have in common? Pinpoint their shared demographics, online behaviors, and the specific pain points your product solves for them. Use these insights to build hyper-specific audience segments in your ad platforms. This ensures your message is only hitting the screens of people who are actually likely to convert.

Just as important is what you're saying. Your ad copy and creative need to speak directly to the unique problems of each audience segment. A generic, one-size-fits-all ad gets scrolled past. A targeted ad that feels like it’s reading the user’s mind? That’s what drives clicks that convert and brings your costs down.

Optimize Landing Pages for Conversion

Driving the right traffic is only half the job. If your landing page can’t convince those visitors to take action, you’re essentially paying to fill a leaky bucket. This is where conversion rate optimization (CRO) becomes your secret weapon.

A high-performing landing page has one job and one job only. It needs a magnetic headline, copy that sells the benefits (not just the features), and a call-to-action (CTA) that’s impossible to ignore.

A/B testing isn't a "nice-to-have"—it's an absolute necessity. You should constantly be testing different page elements like headlines, button colors, images, and form lengths. Even a small lift in your conversion rate, say from 2% to 3%, can cut your CPA by a third without you spending a single extra cent on ads.

This cycle of continuous improvement ensures your landing pages are always working as hard as possible to turn clicks into customers. For a deeper dive, our guide offers more tactics on how to reduce customer acquisition cost across every part of your funnel.

Leverage Partner and Affiliate Marketing

Sometimes the most efficient way to acquire a new customer is to have a trusted voice do it for you. This is the power of affiliate and partner marketing programs, which let you tap into established, engaged audiences with a much more predictable cost structure.

Instead of paying for clicks or impressions and hoping for the best, you typically pay a set commission only after a successful sale is made. This performance-based model completely removes the upfront financial risk and can deliver an incredibly stable and attractive CPA.

Here’s why this channel is so powerful:

- Access to warm audiences: Your partners have already done the hard work of building trust with their followers.

- Pay-for-performance: You only spend money when you make money. The ROI is baked right in.

- Scalable growth: You can expand your reach simply by recruiting more high-quality affiliates into your program.

Building a solid partner program takes some effort, but it’s one of the best ways to create a low-cost, high-intent acquisition channel that grows right alongside your business.

Why Managing Your CPA Is More Critical Than Ever

Ignoring your Cost Per Acquisition is like driving with your eyes closed. Sure, you’re moving forward, but you have no idea if you’re about to drive straight off a cliff. In today’s market, that’s not just a risk—it’s a near certainty.

A couple of powerful forces are conspiring to make every new customer more expensive to win. For one, digital ad platforms are more crowded than ever, which means you’re in a constant bidding war for attention. On top of that, major privacy shifts, like Apple's App Tracking Transparency (ATT) framework, have made it much harder to target and track users, tanking the efficiency of your ad spend.

This isn’t just a small bump in the road; it’s a seismic shift that’s hitting the bottom line, hard.

The Soaring Cost of Customer Acquisition

The numbers don't lie, and they paint a pretty stark picture. Recent data shows that customer acquisition costs have shot up by a staggering 222% over the last eight years. This isn't just a minor trend; it’s fundamentally rewriting the economics of growth for businesses everywhere, and it shows no signs of slowing down. To dig deeper, check out these powerful benchmarks for marketing leaders.

What used to be a manageable expense has now become one of the biggest threats to profitability. Businesses that can't adapt to this high-cost reality risk getting priced right out of the market.

This kind of external pressure forces you to rethink your entire strategy. The old playbook of just pouring more money into campaigns and hoping for the best is officially broken.

From Reactive Spending to Proactive Management

To thrive in this new, more expensive landscape, you have to move from simply spending money to strategically investing it. Managing your CPA is no longer just a task for the finance team; it’s now a core competency for every single marketer.

So, what does that look like in practice? It means you have to:

- Know your numbers inside and out, tracking CPA religiously by channel, campaign, and even ad creative.

- Focus relentlessly on efficiency, optimizing every single touchpoint from the first ad impression to the final thank-you page.

- Invest in channels with predictable costs, like high-performing affiliate and partner programs where the economics are clear from the start.

Ultimately, mastering your what is cost per acquisition calculation isn't just some analytical exercise. It’s about taking back control of your growth and making sure every dollar you spend is working to build a profitable, sustainable business in a world that’s only getting more challenging.

How To Accurately Track And Attribute Conversions

You can't optimize what you can't measure. Calculating your Cost Per Acquisition is a waste of time if the data behind it is shaky, which is why accurate tracking and attribution are completely non-negotiable. This is the only way to give credit where it's due—to the marketing efforts that actually deliver results.

The foundation of solid tracking is setting up your conversion goals. This means using standard tools like Google Analytics to define exactly what a "conversion" means to your business. Is it a sale? A form submission? A free trial signup? You have to decide.

Platform-specific tools, like the Meta Pixel for Facebook and Instagram ads, are also essential. These tiny snippets of code follow what users do after they click your ad, connecting the dots between your ad spend and the conversions it generates. For a full breakdown, check out our guide on what is conversion tracking and how to get it right.

Choosing The Right Attribution Model

Once you're tracking conversions, the next puzzle is attribution. An attribution model is simply the rule you use to decide which touchpoint gets credit for a sale. A customer might see a Facebook ad, click a Google search result, and then open an email before finally buying.

So, who gets the credit? The model you pick directly impacts the CPA for each channel, painting a very different picture of your performance.

There are several common models to think about:

- First-Touch Attribution: This model gives 100% of the credit to the very first interaction a customer had with your brand. It’s great for understanding which channels are best at creating initial awareness.

- Last-Touch Attribution: The opposite approach. This model gives all the credit to the final touchpoint before the conversion. It highlights what’s closing the deal but often undervalues the earlier interactions that warmed up the lead.

- Multi-Touch Attribution: These models spread the credit across multiple touchpoints in the customer journey. Models like linear or time-decay give you a more holistic view of how all your channels are working together to bring home a win.

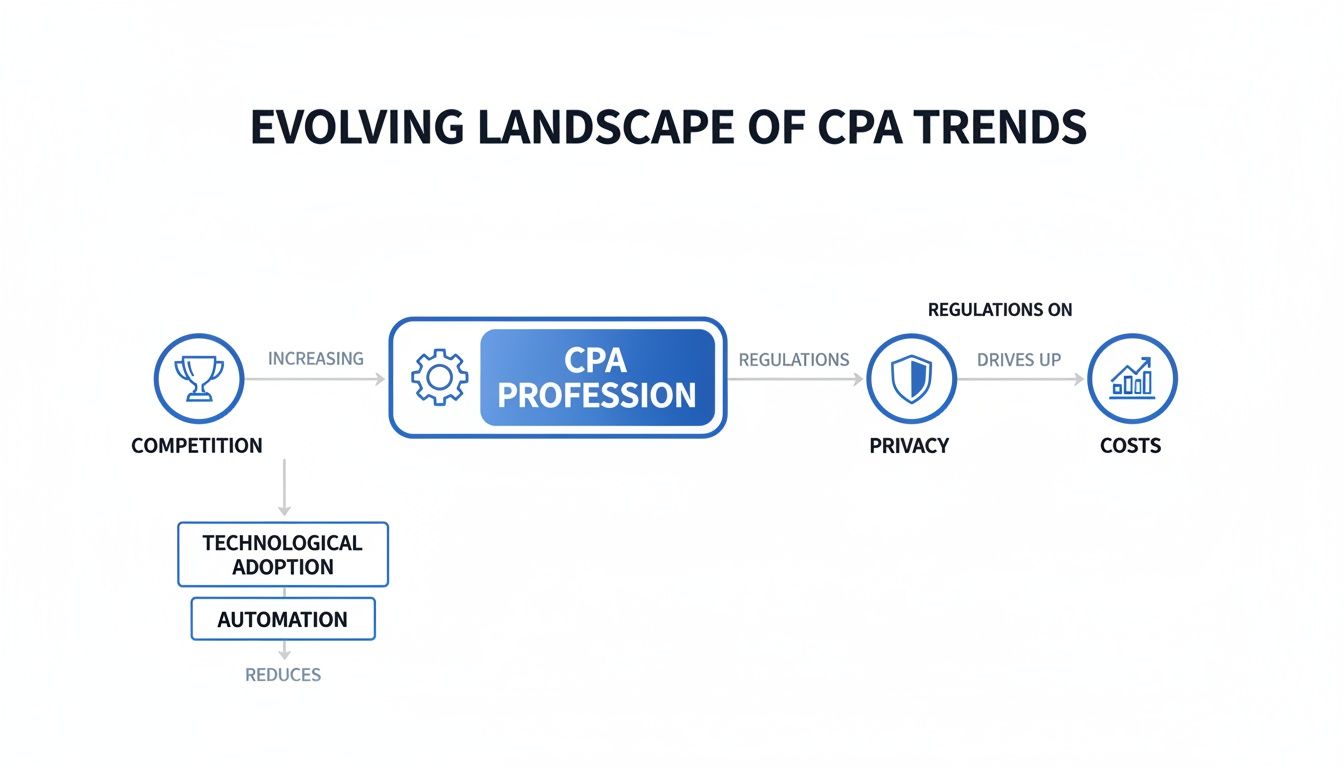

The marketing world isn't static, and neither are acquisition costs. Several key trends are pushing CPA upwards for everyone.

As the flowchart shows, rising competition and new privacy restrictions are making it more expensive to acquire customers than ever before.

The best model depends on your business. For companies with short sales cycles, last-touch attribution might be all you need. But for those with longer, more complex customer journeys, a multi-touch model provides a truer, more balanced view of what’s really driving results.

Answering Your Lingering CPA Questions

Even when the core concepts click, a few practical questions always pop up. Let's tackle the most common ones so you can put this knowledge to work with confidence.

What Is The Difference Between CPA And CPC?

This one is critical. Cost Per Click (CPC) is a top-of-funnel metric; it tells you what you’re paying for a single click on an ad. Cost Per Acquisition (CPA), on the other hand, measures the full cost to get a customer to take a valuable action, like actually buying your product.

Think of it this way: CPC measures attention, but CPA measures results. A low CPC is a good start, but a profitable CPA is what actually builds a sustainable business. One gets you traffic, the other gets you customers.

What Is A Good Cost Per Acquisition?

There’s no magic number that works for everyone. A "good" CPA is completely relative to your business model, industry, and most importantly, your Customer Lifetime Value (LTV).

A solid rule of thumb is to aim for an LTV that's at least three times your CPA. This simple ratio is a powerful health check for your customer acquisition engine.

The 3:1 LTV-to-CPA ratio is the gold standard. For every $1 you spend to acquire a customer, you should be making at least $3 back from them over time.

A $200 CPA might be incredible for a SaaS company with an LTV of $1,000, but it would spell disaster for an e-commerce brand with a $50 average order value. The only benchmark that truly matters is your own.

How Often Should I Check My CPA?

How often you peek at your CPA really depends on the channel you’re using.

For fast-moving paid ad campaigns on platforms like Google or Facebook, you’ll want to check in on a weekly basis. This gives you enough data to spot trends and make smart tweaks without overreacting to the normal ups and downs of a single day.

For channels with a longer feedback loop, like content marketing or SEO, a monthly or quarterly review makes more sense. The goal is to establish a consistent rhythm and watch the trendline, not get lost in noisy, day-to-day fluctuations.

Ready to turn clicks into customers with a predictable CPA? With LinkJolt, you can build, manage, and scale a high-performing affiliate program that delivers consistent results. Create your affiliate program in minutes and start growing today.

Watch Demo (2 min)

Trusted by 300+ SaaS companies

Start Your Affiliate Program Today

Get 30% off your first 3 months with code LINKJOLT30

✓ 3-day free trial

✓ Cancel anytime