What Is Chargeback Fraud and How Can You Stop It?

What Is Chargeback Fraud and How Can You Stop It?

Ollie Efez

January 15, 2026•20 min read

Chargeback fraud is pretty much digital shoplifting. A customer buys something, gets the product or service, and then calls their bank to dispute the charge and get their money back—while keeping what they paid for. It’s a deliberate abuse of a system meant to protect consumers, and it costs businesses billions every year in lost sales, penalty fees, and administrative headaches.

Understanding the Threat of Chargeback Fraud

Think about it this way: a customer subscribes to your SaaS product, uses it for a few weeks, then tells their credit card company the charge was unauthorized. The bank almost always sides with the cardholder and reverses the payment. Now you're out the revenue, the customer got free access to your service, and you get slapped with a non-refundable penalty fee. That's chargeback fraud in a nutshell.

This is worlds away from a legitimate dispute. Customers absolutely have the right to file a chargeback if their card was stolen or if a merchant truly failed to deliver. The real issue is when this consumer protection mechanism gets exploited.

This type of abuse is often called "friendly fraud," but there's nothing friendly about its impact on your bottom line. It’s a massive problem, with some studies suggesting that as many as 86% of all chargebacks could actually be fraudulent.

The Three Faces of Chargebacks

To fight this effectively, you have to understand the intent behind a payment dispute. Not every chargeback is malicious. Some are honest mistakes, and others are completely valid. The trick is learning to tell them apart.

Figuring out the why is critical because each type of dispute needs a completely different response. A legitimate chargeback might signal a flaw in your product delivery. Friendly fraud often points to unclear billing descriptions. And malicious fraud? That requires serious prevention and detection. You can get a deeper dive into the basics in our guide to understanding a chargeback.

Chargeback Fraud vs Legitimate Disputes at a Glance

The table below breaks down the key differences between legitimate customer issues, honest mistakes, and outright fraud. Understanding these distinctions is the first step toward building a solid defense.

Ultimately, identifying the true nature of the disputes hitting your business is crucial. It helps you fix real problems, clarify communication, and shut down bad actors before they can do more damage.Not every chargeback is an open-and-shut case of theft. While some disputes are clear-cut—a stolen card, a product that never arrived—a huge and growing number come directly from your actual customers. This is the murky world of friendly fraud, where a legitimate customer disputes a valid charge, creating a headache that’s incredibly hard to spot.

Imagine someone grabs a quick bite at a local cafe called "The Corner Nook." A week later, they’re scanning their credit card statement and see a charge from "TCN Hospitality Group LLC." They don't recognize the name. Instead of picking up the phone to ask, they file a chargeback, assuming it’s fraud. They didn't mean to cause harm, but the result is the same: the cafe is out the cost of the meal and gets hit with a penalty fee.

That’s friendly fraud in a nutshell. It’s born from confusion, not malice, but it hurts your bottom line just as much as a deliberate scam.

The SaaS Free Trial Trap

This problem is everywhere in the SaaS world. Picture this: a user signs up for a free trial of your project management tool. They pop in their credit card details to unlock all the features, use the software for a couple of weeks, and then completely forget to cancel before the trial period ends.

When the first monthly charge hits their statement, they have no memory of authorizing it. Rather than shooting your support team an email to ask for a refund, they take the path of least resistance—they call their bank and dispute the charge.

To the bank, the customer’s claim of an "unauthorized transaction" looks legitimate. Just like that, an act of simple forgetfulness turns into a case of chargeback fraud, costing you the subscription fee plus a chargeback penalty. It's a classic example of first-party misuse, where the cardholder themselves is the source of the problem, not some shadowy hacker.

Why Is Friendly Fraud So Hard to Catch?

The real challenge with friendly fraud is that it comes from genuine customers using their own cards. These transactions look perfectly normal to every fraud filter on the planet because, well, they are normal.

- The IP address lines up with the billing country.

- The card verification value (CVV) is correct.

- The purchase is made from a device with a legitimate history.

Since the actual cardholder is the one making the purchase, there are none of the usual red flags for an automated system to catch. It’s a completely valid transaction right up until the moment your customer decides to dispute it. This makes preventing it a game of clear communication, not just better security.

Friendly fraud is the silent majority of chargebacks. It isn't driven by criminal rings but by everyday customers who are confused, forgetful, or just have a bit of buyer's remorse. This makes it a uniquely human problem that demands a human-focused solution.

The scale of this issue is staggering. Chargeback fraud, fueled largely by this kind of first-party misuse, is exploding. Projections show that fraudulent chargebacks alone are on track to cost businesses a stunning $15 billion in 2025. That number doesn't even include legitimate disputes, highlighting just how often consumers are using the chargeback system for things it was never meant for. In fact, first-party fraud now accounts for 45% of all chargebacks, showing how common it is for customers to get what they paid for and dispute the charge anyway. You can dig into the full findings of this Mastercard-backed study on chargeback costs. This trend makes it absolutely critical for businesses to understand the fine line between an honest mistake and intentional abuse.

The True Cost of Chargeback Fraud for Your Business

The initial lost sale from a fraudulent chargeback? That's just the tip of the iceberg. The real damage is lurking just beneath the surface, where a whole host of hidden costs can slowly and quietly bleed your business dry. It’s a sneaky problem that gets more expensive with every single dispute.

When a customer files a chargeback, the bank doesn’t just take back the original transaction amount. They also slap you with a separate, non-refundable dispute fee. This penalty, which typically runs between $20 and $100, is your punishment for the inconvenience—and you get hit with it whether you win or lose the dispute.

Think about it. A fraudster disputes a $50 SaaS subscription. You lose that $50 in revenue right away. Then, your payment processor tacks on a $35 dispute fee. Just like that, a single fraudulent transaction has cost you $85, not just the price of your service.

Beyond the Financial Penalties

The direct monetary losses are bad enough, but they don't even begin to cover the operational nightmare that follows. Every chargeback forces your team to drop everything and scramble, kicking off an internal investigation to fight the claim.

This whole process is a massive time sink, pulling your team away from tasks that actually grow the business. They have to:

- Gather Evidence: This means digging through IP logs, server access records, customer support chats, and usage data to prove the transaction was legitimate.

- Craft a Rebuttal: Next, they have to stitch all that evidence into a coherent, compelling response that directly addresses the customer's claim.

- Submit and Track: Finally, they submit everything through your payment processor’s portal and then wait. And wait. A resolution can often take weeks or even months.

This entire ordeal is a costly distraction. The hours spent fighting a single $50 chargeback could have been spent improving your product, helping real customers, or closing new deals.

The Affiliate Program Nightmare

For SaaS companies running affiliate programs, chargeback fraud adds another painful layer of complexity. When a customer referred by an affiliate files a fraudulent chargeback, the fallout ripples through your entire partner ecosystem.

First, you’re forced to perform a commission clawback. That means reversing the commission you already paid to the affiliate for that sale. Not only is this an administrative headache, but it can also seriously sour your relationship with good partners. Affiliates depend on predictable income, and constant clawbacks breed frustration and distrust.

A high chargeback rate tied to an affiliate’s referrals is a massive red flag. It can poison your entire program, forcing you to terminate partnerships and making legitimate affiliates question the stability of your offer.

The problem is getting worse. A recent "refund hack" trend on social media is actively teaching people how to file bogus claims, contributing to a shocking 233% surge in retail e-commerce chargebacks from Q1 to Q3 2025. With digital subscriptions being a prime target (making up 18% of these disputes), SaaS affiliate programs are directly in the line of fire. You can learn more about this surge in chargeback trends.

The Ultimate Risk: Merchant Account Termination

Perhaps the most dangerous cost of all is the threat to your merchant account. Payment processors like Stripe and Paddle are watching your chargeback rate like a hawk. If your dispute ratio climbs above their threshold—usually around 0.75% to 1% of your total transactions—they can label your business as "high-risk."

Getting slapped with a high-risk label can trigger higher processing fees, mandatory cash reserves, or, in the worst-case scenario, the termination of your account entirely. Losing your ability to process payments is a death sentence for any online business. This is why understanding and fighting what is chargeback fraud isn’t just an accounting issue—it’s a matter of survival.

How to Spot the Warning Signs of Chargeback Fraud

Getting ahead of chargeback fraud is always better than cleaning up the mess afterward. To go on the offensive, you need a practical playbook for spotting the warning signs. These red flags often pop up long before a dispute is ever filed, giving you a crucial window to step in.

Think of it like being a detective. A single clue might not mean much, but a collection of suspicious details starts to paint a very clear picture. The same goes for spotting potential fraudsters—you're looking for patterns that just don't match up with how a real customer acts.

High-Risk Transaction Signals

Fraudsters often leave a trail of digital breadcrumbs. Their main goal is to get what they want and get out fast, and that urgency usually leads to sloppy mistakes. Once you understand the mindset, you can learn to recognize the telltale signs they leave behind.

Here are some of the most common signals that a transaction might be bogus:

- Address Mismatches: This is a classic. The billing address and shipping address don't match, especially if they're in different states or countries. Sure, people send gifts, but it’s a go-to tactic for criminals using stolen credit cards.

- Disposable Email Addresses: When a customer signs up for a high-value subscription using a temporary or disposable email, your alarm bells should be ringing. Real customers use a permanent email they check for receipts and account updates.

- Multiple Failed Payments: A string of failed payment attempts followed by a sudden success is a huge red flag. This often means a fraudster is burning through a list of stolen card numbers until one finally works. A legitimate customer might mistype their info once, but numerous failures are highly unusual.

These signals are the building blocks of any solid fraud prevention strategy. You can dive deeper into the technical side of this in our guide on fraud detection in online payments.

Unusual Customer Behavior Patterns

Beyond the raw transaction data, the way a person behaves can give them away. Fraudsters are almost always in a rush and don't act like genuine buyers who have a real interest in your service.

A massive first-time order, especially for your most expensive plan, is a dead giveaway. Fraudsters want to extract maximum value before the stolen card is inevitably reported. A real customer, on the other hand, is far more likely to start with a lower-tier plan to test the waters first.

By looking for behavior that doesn't align with a genuine customer journey, you can flag suspicious accounts for manual review. This simple step can prevent a significant number of fraudulent chargebacks before they even have a chance to occur.

Red Flags in Your Affiliate Program

Don't forget, your affiliate program can also become a prime target for sophisticated chargeback schemes. Scammers will sometimes pose as affiliates, driving sign-ups with stolen credit cards to rack up commissions, only to leave you dealing with a wave of disputes weeks later.

Be wary of a single affiliate who suddenly drives a massive, unnatural spike in sign-ups, especially if many of those new customers originate from the same IP range. This almost always signals a coordinated attack on your system. Keeping a close eye on affiliate performance for these odd patterns is key to protecting both your program's integrity and your bottom line.

And the threat is only getting worse. Global chargeback volumes are projected to jump 24% between 2025 and 2028, and merchants believe a staggering 45% of these are outright fraudulent. With the average chargeback in the U.S. valued at $110, the financial stakes are incredibly high. These trends are fueled by card-not-present digital purchases, which now make up 63% of all transactions. You can learn more about these chargeback statistics and what they mean for merchants.

Your Action Plan for Preventing and Fighting Chargebacks

Knowing the enemy is half the battle, but having a solid plan is how you win. Let's turn theory into action with a two-pronged approach: proactive prevention to stop disputes before they happen, and a rock-solid dispute process to win back the ones that slip through. It’s all about making small, strategic changes that deliver a big impact.

The best defense is a good offense. A surprising number of chargebacks, especially the “friendly fraud” variety, are just the result of simple confusion. By making your customer interactions clearer and more transparent, you can cut off these costly misunderstandings at the source.

Building Your Prevention Playbook

A cornerstone of any good plan is putting in place robust internal controls to prevent fraud, which are your first line of defense against chargeback risks. Small, consistent actions can drastically lower your dispute rate and save you a fortune in fees and lost sales.

Start with these simple but incredibly powerful tactics:

- Use Clear Billing Descriptors: Take a look at your bank statement. Does the charge say "SP YourSaaSCo" or a generic processor name like "Stripe"? Unrecognized charges are a leading cause of friendly fraud. Make sure your descriptor is instantly recognizable to your customers.

- Send Renewal Reminders: If you run a subscription service, always send an email reminder a few days before a recurring charge hits. This simple courtesy gives customers a chance to cancel if they've forgotten, preventing a surprise charge and an angry dispute.

- Maintain Transparent Policies: Your terms of service, refund policy, and cancellation process shouldn't be buried. Hiding this information only encourages frustrated customers to go straight to their bank instead of contacting your support team for help.

- Provide Excellent Customer Service: Make it ridiculously easy for customers to contact you. A prominent support email, live chat, or phone number can intercept potential disputes before they ever happen. Remember, a quick refund is almost always cheaper than a chargeback.

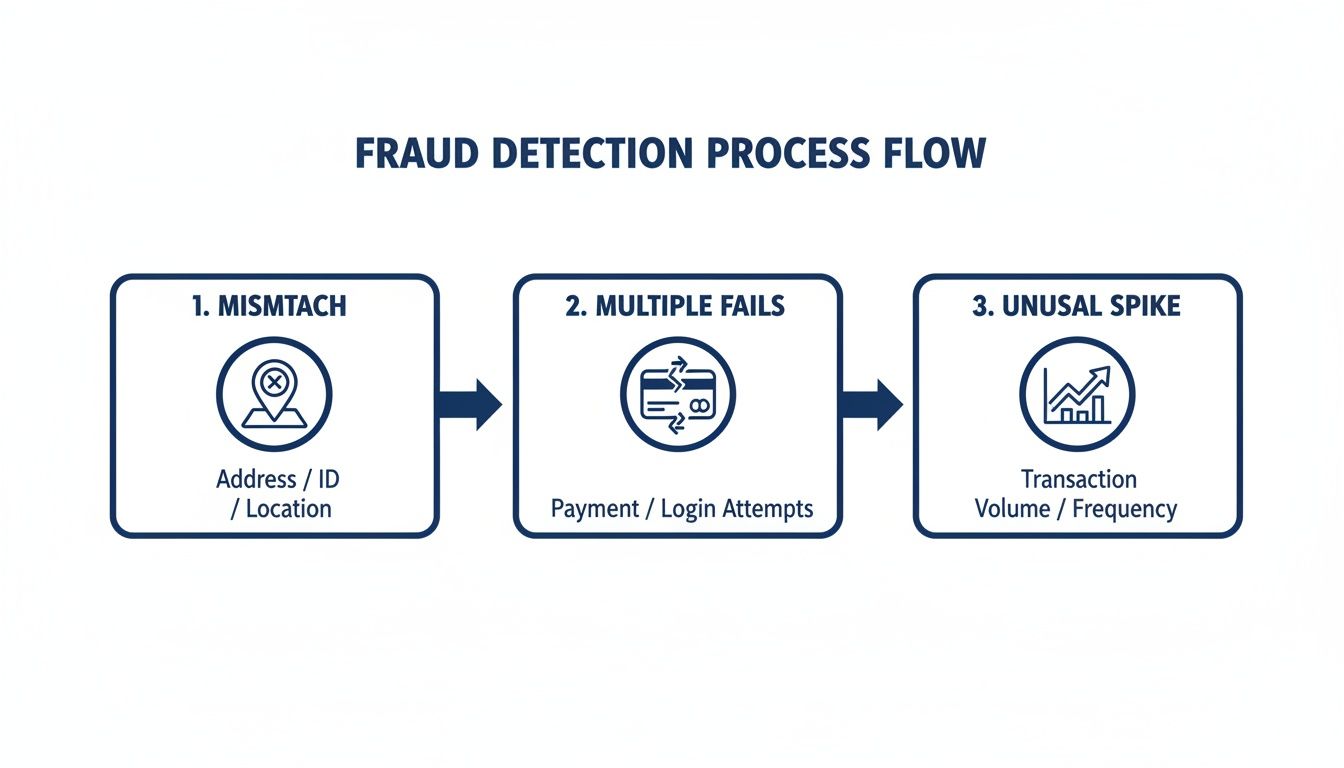

This flow chart breaks down a simple process for spotting common red flags as they happen.

This visual shows how things like data mismatches, repeated payment failures, and sudden spikes in activity are key signals that can help you flag and block fraudulent transactions before they become a problem.

How to Fight Back and Win Disputes

Even with the best prevention strategy in the world, some fraudulent chargebacks are just inevitable. When that happens, you need a clear, evidence-based process for fighting back. Winning a dispute is all about presenting an undeniable case that proves the transaction was legitimate and the service was delivered.

Banks and card networks want to see compelling evidence. Your job is to provide so much proof that the cardholder’s claim looks completely baseless. A vague rebuttal just won’t cut it; you need to build a detailed case file for every single dispute.

When you fight a chargeback, you're not just recovering revenue from a single transaction. You're sending a message to fraudsters that your business is not an easy target, which can deter future attempts.

Here’s a step-by-step guide to gathering the evidence you need to build an ironclad case:

- Gather Transaction and User Data: Start with the basics. Collect the customer’s name, email, billing address, and the last four digits of the card used. This establishes the identity of the person who made the purchase.

- Collect Digital Footprints: This is where you find your most powerful evidence. Pull the IP logs that show where the user signed up from and where they accessed your service. Make a note if the IP address country matches the customer’s billing country—it's a strong signal of legitimacy.

- Show Proof of Use: For SaaS businesses, this is absolutely critical. Compile usage data that shows the customer logged in, used features, downloaded reports, or interacted with your platform after* the purchase. This directly refutes any claim that the service wasn't used or that the purchase was unauthorized.

- Include All Communications: Did the customer ever contact your support team? Include full transcripts of emails, live chats, or notes from phone calls. This communication proves they had an active relationship with your business.

Putting it all together creates a powerful story. For example, you can show that a user with an IP address in New York signed up for your service, logged in ten times from that same IP, and even sent a support ticket asking for help—all before claiming the charge was fraud. This kind of detailed evidence trail makes winning disputes far more likely.

Integrations with payment processors like Stripe and Paddle are essential here, as they provide the foundational transaction data you need. When you combine that with a platform like LinkJolt, which tracks affiliate referrals and conversion data, you get a complete picture that can stop chargeback fraud in its tracks.

Your Chargeback Prevention and Dispute Checklist

To keep things simple, here’s an actionable checklist you can use to build a stronger defense against chargebacks, covering both proactive measures and the reactive steps you need to take when a dispute lands.

Following this checklist doesn't just help you win individual disputes; it strengthens your entire business by reducing financial leaks and sending a clear signal that you take fraud seriously.Protecting Your Affiliate Program from Chargeback Schemes

Your affiliate program should be a powerful growth engine, not a secret backdoor for fraudsters. Without the right oversight, a single bad-faith affiliate can flood your system with bogus sales generated from stolen credit cards, leaving you to deal with a tidal wave of chargebacks weeks later.

This is where a dedicated affiliate management platform becomes your most important line of defense. Modern platforms like LinkJolt are built to protect program integrity from the ground up, with automated fraud detection that flags suspicious activity before it spirals out of control.

Spotting Affiliate Fraud in Action

Imagine a SaaS company notices a new affiliate driving an unusually high number of sign-ups for their premium plan. Instead of celebrating, they use their platform’s real-time analytics to dig deeper. They quickly spot a series of classic red flags:

- Conversion Clustering: A suspiciously large number of sign-ups are all coming from a narrow range of IP addresses.

- Low-Quality Traffic: Click-through rates are high, but user engagement post-signup is completely dead. Nobody is actually using the software.

- Identical User Data: Many of the new "customers" use similar naming patterns or disposable email addresses.

This pattern is a textbook case of affiliate-driven chargeback fraud. The affiliate is almost certainly using stolen card details to generate fake sales just to collect commissions, knowing the chargebacks won't hit for weeks.

By spotting these irregularities early, the company can immediately pause the affiliate's account, preventing dozens of future fraudulent sales. This single action saves them thousands of dollars in lost revenue, dispute fees, and clawed-back commissions.

Proactive Protection with the Right Tools

An effective defense combines vigilance with technology. An affiliate platform acts as your central command center, giving you the visibility needed to run a clean and profitable program. The key is to have protective features working for you around the clock.

Key features to look for include:

- Automated Monitoring: The system should instantly flag unusual conversion patterns—like a sudden, massive spike in sales from a brand-new affiliate—for you to review.

- Performance Analytics: Detailed dashboards let you track affiliate performance over time, making it easy to spot anomalies when compared to your trusted, long-term partners.

- Seamless Integrations: The platform must connect directly with your payment processors like Stripe and Paddle, correlating sales data with affiliate referrals to create a clear evidence trail for any disputes.

Protecting your program isn't just a feature; it's essential for sustainable growth. By implementing robust tools, you can ensure your affiliates are valuable partners, not liabilities. You can learn more about how LinkJolt provides advanced affiliate fraud prevention to secure your revenue and maintain program integrity.

This proactive approach transforms your affiliate channel from a potential risk into a secure, scalable engine for your business.

Got Questions About Chargeback Fraud? We’ve Got Answers.

When you're dealing with chargebacks, a lot of questions come up. Let's tackle some of the most common ones you'll run into as you put these strategies into practice.

How Long Does a Chargeback Dispute Take?

Get ready to be patient. Once you’ve submitted all your evidence, it can take anywhere from 30 to 90 days for the card-issuing bank to come to a decision.

This slow-moving timeline is exactly why getting ahead of fraud is so important. Waiting up to three months for a resolution on a single transaction is a major drain on your time and cash flow.

What Is an Acceptable Chargeback Rate?

Most payment processors, like Visa and Mastercard, want to see your chargeback rate stay below 0.9% of your total transactions.

If your rate starts creeping over 1%, you're heading into dangerous territory. You could get flagged as a "high-risk" merchant, which often leads to higher processing fees, frozen funds, or even having your merchant account shut down entirely. For an online business, that's a nightmare scenario.

Staying below the threshold isn't the real goal—it's getting your rate as close to zero as possible. Every single dispute, whether you win or lose, costs you time and money in non-refundable fees and team effort.

Can I Fight Every Single Chargeback?

Technically, yes. Strategically? Absolutely not. You have to pick your battles and weigh whether the effort of fighting is worth the potential reward.

Before you jump into a dispute, ask yourself these questions:

- What's the transaction value? Fighting over a $10 chargeback might cost you more in your team's time than you'd ever get back.

- How strong is my evidence? If you don't have solid proof of authorization or service usage, your chances of winning are pretty slim. Don't waste your energy.

- Who is the customer? If a long-time, high-value customer made an honest mistake, offering a quick refund might be the smarter move to preserve that relationship.

When Should I Invest in a Fraud Prevention Tool?

The time to invest in a dedicated tool is when you start seeing a clear pattern of fraud or when your team is spending too much time manually reviewing orders. Early on, the tools built into your payment processor might be enough, but as you grow, so will the number and sophistication of fraud attempts.

A platform designed for fraud detection automates the heavy lifting, protecting your bottom line while freeing up your team to focus on growing the business.

Ready to protect your affiliate program from costly chargeback schemes? LinkJolt offers automated fraud detection and real-time analytics to safeguard your revenue and ensure your partners are a source of growth, not risk. Learn how LinkJolt can secure your business today.

Watch Demo (2 min)

Trusted by 300+ SaaS companies

Start Your Affiliate Program Today

Get 30% off your first 3 months with code LINKJOLT30

✓ 3-day free trial

✓ Cancel anytime