A Guide to Fraud Detection in Online Payments

A Guide to Fraud Detection in Online Payments

Ollie Efez

November 20, 2025•21 min read

When we talk about fraud detection in online payments, we're essentially talking about stopping thieves before they walk out the door. It’s a digital bouncer for your business, analyzing every transaction in real-time to spot suspicious behavior and block it cold. This isn't just a nice-to-have; it's a critical defense for protecting your revenue and keeping your customers' trust.

Why Online Payment Fraud Is a Growing Threat

Think of your SaaS platform or online store as a busy city square. Most people are there to shop and enjoy themselves, but there are also pickpockets lurking in the crowd. These aren't clumsy amateurs; they're organized crooks using automated bots and stolen credentials to find and exploit any weakness in your payment system.

This isn't just a tech issue—it’s a direct hit to your bank account. Every fake transaction can trigger a chargeback, vaporize your revenue, and create a mountain of administrative work. And the problem is only getting bigger.

The Financial Impact of Online Fraud

The numbers here are genuinely eye-watering. Global losses from digital payment fraud are on track to blow past $50 billion by 2025. Right now, the fraud attack rate hovers around 3.3% of all transactions worldwide, with credit card fraud leading the charge at about 35% of all cases. You can dig into more of these digital payment fraud statistics at CoinLaw.io.

But the damage goes way beyond the initial lost sale. It creates a domino effect across your entire business:

- Eroding Customer Trust: Once a customer gets a fraudulent charge from your site, winning them back is nearly impossible. They'll simply go to a competitor they feel is safer.

- Increasing Operational Costs: Your team ends up wasting precious hours and energy fighting chargeback disputes and manually reviewing transactions—time they should be spending on growing the business.

- Risking Processor Relationships: Payment processors like Stripe or Paddle have little patience for high fraud rates. You could face higher fees or, in a worst-case scenario, lose your payment processing account entirely.

In essence, ignoring online payment fraud is like leaving your front door wide open with a sign that says, "Help Yourself." Eventually, someone will, and the losses will be far greater than the cost of installing a good lock.

Why a Proactive Defense Is Non-Negotiable

Waiting to deal with fraud after it’s already happened is a losing game. Today's fraudsters are fast and automated. By the time you notice a problem, they're long gone with the money, and you're left to clean up the mess.

Effective fraud detection in online payments has to be proactive. It's about having systems in place that can identify and shut down shady activity the second it happens. This guide will walk you through exactly how to build that defense to protect your business, your revenue, and your hard-earned customer relationships.

Recognizing the Tactics of Modern Fraudsters

To build a solid defense, you first have to get inside the mind of your opponent. Modern fraudsters are crafty and relentless, always finding new ways to poke holes in online payment systems. Knowing their playbook is the only way you can get ahead of them.

Their methods range from clumsy, brute-force attacks to sophisticated schemes designed to trick your business systems. Let's break down the most common types of fraud you're likely to run into.

A Snapshot of Common Online Fraud Types

Before we dive deep, here's a quick look at the different schemes fraudsters use, who they typically target, and the damage they can cause.

Each of these tactics presents a unique challenge, making it crucial to understand the nuances of how they work.Card-Not-Present Fraud

Think of Card-Not-Present (CNP) fraud like a thief who has a copy of your house key but has never seen your house. They don't have the physical credit card, but they’ve got all the critical info needed to use it online: the card number, expiration date, and that little three-digit CVV code.

Where do they get this information? Usually from massive data breaches, sneaky phishing emails, or malware. The fraudster then takes these stolen details to an e-commerce store or SaaS platform and makes a purchase, since no physical card is needed to verify it. The real cardholder often has no idea until they get their monthly statement, giving the fraudster days or even weeks to cause damage.

Chargeback Fraud

Chargeback fraud, which is sometimes cheekily called "friendly fraud," is the digital version of dining and dashing. A real customer buys something from you, receives the product or service, and then calls their bank to claim the charge was fraudulent or that the item never showed up.

The bank, wanting to protect its customer, will often initiate a chargeback, which forcibly yanks the money right out of your business account. This is a triple whammy: you lose the revenue, you lose the product, and you get hit with a painful chargeback fee from your payment processor.

A high volume of chargebacks signals to payment processors that your business is high-risk. This can lead to increased processing fees, mandatory cash reserves, or even the termination of your merchant account, making it difficult to accept payments at all.

Credential Stuffing and Account Takeover

Imagine a burglar with a giant ring of a million random keys, trying every single one on every door in your neighborhood. That's credential stuffing in a nutshell. Fraudsters use automated bots to hammer your login page with huge lists of stolen usernames and passwords, hoping for a match.

When they get a hit, they've successfully pulled off an Account Takeover (ATO). Once they're inside a legitimate user's account, they can go on a shopping spree with saved credit cards, steal personal information, or cash out loyalty points.

This approach is scarily effective because so many people reuse passwords across different websites. In fact, loyalty programs are now a bigger target than credit cards. The Digital Trust Index recently found that loyalty points fraud had the highest attack rate at 6.19%.

Affiliate and Referral Fraud

This last one is a direct attack on your marketing budget. Affiliate fraud happens when bad actors game your affiliate program to generate commissions they didn't earn. They'll use bots to create thousands of fake clicks, bogus sign-ups, or phony leads, making it look like they're sending you real customers.

Your business ends up paying out commissions for traffic that will never convert, essentially lighting your marketing dollars on fire. It not only drains your budget but also completely messes up your performance data, making it impossible to know which marketing efforts are actually working. To learn more about fending off these schemes, check out these common affiliate marketing scams detailed in our guide.

Essential Tools for Your Fraud Detection Toolkit

Knowing what kind of fraud you’re up against is half the battle. The other half is having the right tools to fight back. When it comes to fraud detection in online payments, there’s no single magic bullet. The best approach is to layer different technologies to build a defense that’s both tough and smart.

Think of it like securing a high-value building. You don't just put one lock on the front door and call it a day. You have security guards, cameras, and motion sensors all working in concert to cover every possible angle.

Rule-Based Systems: The Digital Bouncer

The most straightforward tool in your kit is a rule-based system. This is your digital bouncer, standing at the door with a strict checklist. It works on simple "if-this-then-that" logic.

For instance, you can set rules like:

- IF a transaction is over $1,000 AND the shipping address doesn't match the billing address, THEN flag it for a human to review.

- IF more than three purchases come from the same IP address within an hour, THEN put a temporary block on that IP.

- IF someone tries five different credit cards in under ten minutes, THEN lock the account.

These systems are fantastic for catching obvious, clear-cut fraud patterns. They’re predictable, easy to set up, and give you direct control. But they’re also rigid. Fraudsters are clever and quickly learn to skirt around fixed rules, which makes this a solid first line of defense but not a complete solution by itself.

Machine Learning and AI: The Seasoned Detective

This is where your fraud detection gets really sharp. If rule-based systems are the bouncers, machine learning (ML) and artificial intelligence (AI) are the seasoned detectives. Instead of just following a static list of rules, these systems learn from mountains of historical transaction data to spot subtle, complex patterns a human could never hope to see.

An ML model can analyze thousands of data points in a split second—transaction amount, time of day, device type, past purchase history—to calculate a real-time risk score. It never stops learning. When a new fraud tactic pops up, the model spots it, learns its signature, and gets better at stopping it the next time.

AI's ability to create and detect complex fraud is a double-edged sword. While it powers our best defenses, it also fuels more convincing schemes. Synthetic identity fraud, where AI blends real and fake data to create new identities, is a prime example of this threat.

This adaptive learning is absolutely critical. A particularly nasty trend is synthetic identity fraud, where criminals use AI to cook up entirely new, believable identities from a mix of real and fake information. This type of fraud is projected to cause global losses of $58.3 billion by 2030, which really drives home the need for equally sophisticated detection tools. You can dive deeper into this with in-depth research on financial fraud trends.

Behavioral Analytics: The Digital Body Language Expert

Behavioral analytics adds another powerful layer by looking at how a user interacts with your site, not just what they’re doing. Think of it as analyzing a customer’s "digital body language" for red flags.

A real customer usually browses, compares a few things, and then checks out. A fraudster, on the other hand, often acts strangely:

- Unusual Mouse Movements: Frantic, jerky mouse movements or unnaturally perfect, straight lines often signal a bot is at work.

- Rapid Form Filling: Copying and pasting stolen info into checkout fields way faster than any human could type.

- Hesitation on Specific Fields: A long pause on the CVV or zip code field could mean they're cycling through a list of stolen card details.

By watching for these subtle cues, you can flag a session as suspicious even if all the transaction details look fine on the surface. It’s a great way to catch both bots and manual fraudsters.

Device Fingerprinting: The Unique Digital ID

Finally, device fingerprinting gives you a way to identify the specific device—the computer, phone, or tablet—being used for a transaction. It works by gathering a unique combination of data points from the device itself, like its operating system, browser version, screen resolution, language settings, and installed plugins.

All these details combine to create a unique "fingerprint." So, if a fraudster tries to make dozens of purchases with different stolen cards but from the same laptop, your system will recognize the fingerprint and shut them down. It’s an incredibly powerful tool for stopping organized, large-scale attacks. For businesses with partners, layering these tools is a core part of any good affiliate fraud prevention strategy.

By blending these four tools—rules, machine learning, behavioral analytics, and device fingerprinting—you create a multi-layered defense that is much, much harder for criminals to break.

Putting Your Fraud Protection System to Work

Alright, so you understand the threats and the tools used to stop them. Now comes the practical part: putting it all into action. The great news is you don't have to build a sophisticated fraud detection system from the ground up. Top-tier payment processors like Stripe and Paddle already have powerful, built-in fraud prevention suites ready for you to flip on and customize.

Think of it like moving into a house with a high-tech security system already installed. You don't need to run wires through the walls yourself. Instead, your job is to learn the control panel, set the right sensitivity, and decide which doors and windows need a little extra attention. Let's walk through how to configure these tools to build a defense that’s both strong and smart.

Getting Started with Stripe Radar

If your business runs on Stripe, your go-to tool is Stripe Radar. It’s a machine learning powerhouse that scrutinizes every single transaction, comparing it against a massive dataset from millions of businesses around the globe. Right out of the box, it automatically blocks a ton of high-risk payments without you having to lift a finger.

But the real magic is in the customization. You can fine-tune its behavior to perfectly match your business's unique risk profile. This really boils down to two key components:

- Risk Levels: Radar gives every payment a risk score, sorting it into normal, elevated, or high risk. You get to decide how to handle each category. You might let normal payments sail through, flag elevated ones for a manual look, and automatically block anything high-risk.

- Custom Rules: This is where your own business intelligence comes into play. You can create specific "if-this-then-that" rules to block or review payments based on things like IP address location, the type of card used, or how many transactions are happening in a short period.

The name of the game is balance. If your rules are too aggressive, you'll start getting "false positives"—blocking real customers and frustrating them. But if your rules are too lax, you're leaving the door wide open for fraudsters. The sweet spot is maximum security with minimal friction for your good customers.

Before you go live with any rules, testing is absolutely crucial. A great way to do this is by using a variety of Stripe test cards in a sandboxed environment to see exactly how different scenarios will trigger your fraud rules.

Configuring Rules and Alerts

Crafting effective rules isn’t about trying to block every imaginable threat. It’s about zeroing in on the patterns that are most relevant to your business. For instance, a SaaS company might notice that fraudsters love using prepaid debit cards for a quick sign-up right before they file a chargeback.

Here are a few practical rules you could set up today:

- Block payments where the customer's billing country and IP address country don't match.

- Request 3D Secure authentication for the very first transaction from any new customer.

- Send to manual review any transaction over $500 that comes in between 2 AM and 5 AM in your main time zone.

Once your rules are active, alerts are the next critical piece. You should have notifications set up to ping your team whenever a payment is blocked or sent for manual review. This enables you to take quick action, assess flagged payments, and tweak your rules based on what's actually happening. For a truly solid setup, you'll want to implement comprehensive ecommerce fraud prevention across your entire payment flow.

Interpreting Risk Scores and Making Decisions

Rules are great for the black-and-white cases, but risk scores help you navigate the gray areas. A risk score, usually a number from 0 to 99, is the machine learning model's best guess on how likely a transaction is to be fraudulent. Anything 75 or higher is generally considered a red flag.

When a payment gets flagged for manual review, the risk score and the signals behind it are your key pieces of evidence. The system won't just give you a number; it will tell you why it thinks the payment is sketchy. It could be a brand new email address, an IP address from a known proxy, or a card that’s been linked to disputes before. Your team can then use that context to make a smart call: approve it, block it, or maybe even reach out to the customer for a quick verification.

Designing Your Fraud Response Workflow

Spotting a sketchy transaction is one thing, but what you do next is what really protects your business. Without a clear plan, your team gets buried in alerts. That’s when bad things happen: you either make slow decisions, accidentally block good customers, or let actual fraud slip right past you.

Think of your fraud response workflow as your team's playbook. It lays out exactly how to handle every alert, making sure every suspicious transaction gets treated the same way, every time. This isn't just about stopping criminals; it’s about making sure your legitimate customers have a great experience while you keep your revenue safe.

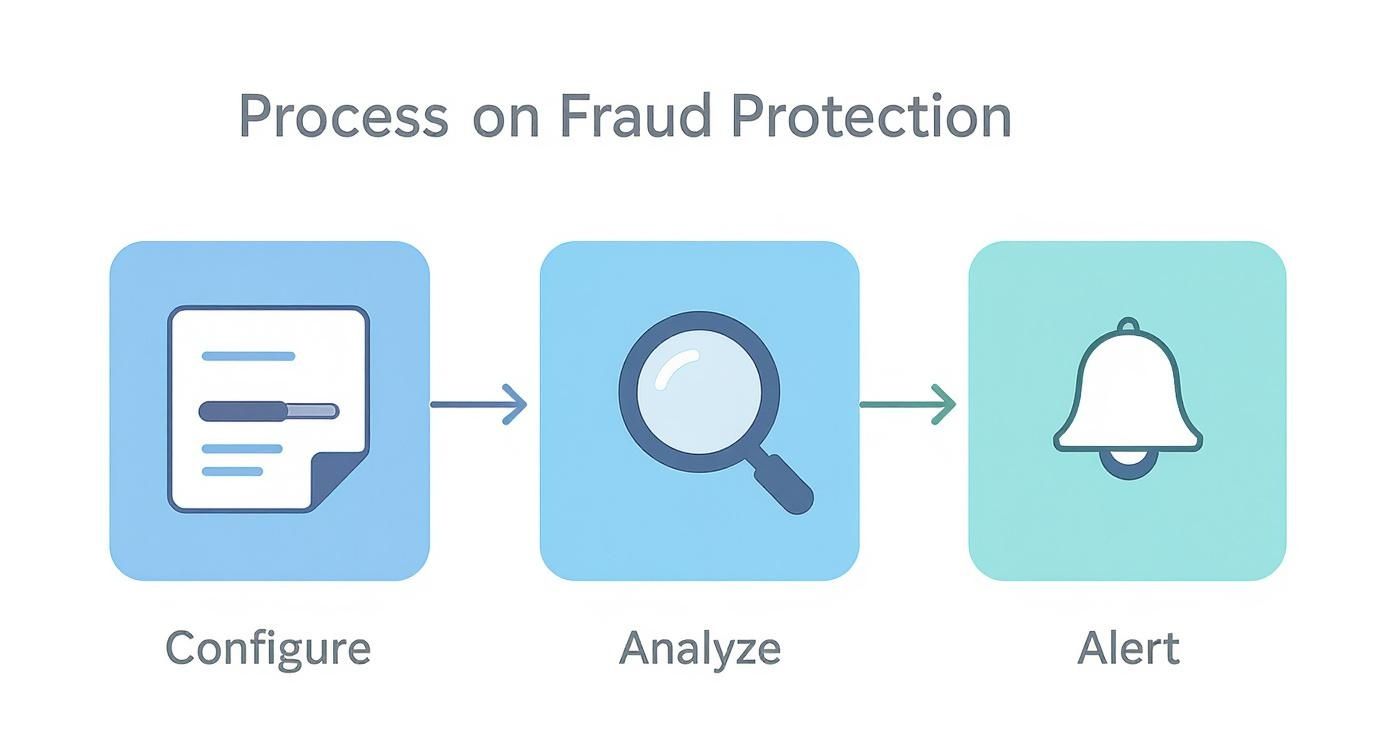

The process is a constant loop: you set the rules, see what they catch, and act on the alerts. It’s not a "set it and forget it" kind of deal.

This cycle is the core of effective fraud detection in online payments. You're always learning and adjusting based on what you see.

Building Your Response Tiers

You can’t treat every transaction like it’s a high-stakes heist. That’s where a tiered response comes in. You match your reaction to the level of risk, which keeps things smooth for good customers while putting up a wall against the obvious threats.

Your workflow should really have three main paths:

- Auto-Approve: These are the no-brainers. Transactions with super low risk scores should fly through without a hitch. Don't make your best customers jump through hoops.

- Manual Review: This is for the "hmm, that's a little weird" transactions. They're not obviously fraudulent, but something’s off. These need a real person to take a closer look.

- Auto-Block: For the high-risk, five-alarm-fire transactions. If an order trips a major red flag (like coming from a device you know belongs to a fraudster), shut it down immediately.

For manual reviews, your team needs a game plan. Give them a checklist: check the IP location against the shipping address, look at the order details, see if they have a purchase history, and understand what signals your fraud tool flagged.

The goal of a manual review isn't just to say "yes" or "no." It's an opportunity to gather intelligence that helps you fine-tune your automated rules, making your entire system smarter over time.

Handling Disputes and Chargebacks Gracefully

No matter how good your defenses are, chargebacks are going to happen. The way you handle them says a lot about your business and is critical for keeping your payment processor happy. Your response workflow needs a clear, step-by-step process for this.

Make sure your team knows exactly what to do:

- Gather Evidence Promptly: The second a dispute comes in, they need to pull all the transaction records—customer emails, delivery confirmations, server logs, everything.

- Assess the Dispute: Figure out what you're dealing with. Is this legitimate fraud, or is it "friendly fraud" where a customer is trying to get something for free?

- Respond Professionally: Put together a clean, organized response for the payment processor. Present your evidence clearly and concisely to make your case.

This isn’t just about winning more disputes. A structured approach shows payment processors you're a serious, responsible merchant. It turns a stressful, reactive mess into a predictable system that protects your money and makes your business more secure.

Key Metrics for Your Fraud Detection Dashboard

To know if your workflow is actually working, you need to track the right numbers. A good dashboard gives you a live look at your performance, helping you spot trends and fix problems before they get out of hand.

Keeping an eye on these metrics will help you fine-tune your rules, train your team better, and ultimately build a more resilient and profitable business.Your Action Plan for a More Secure Business

Protecting your business from fraud isn't something you set up once and forget. It's a constant process of staying alert and adapting. Now that you understand the threats and the tools for solid fraud detection in online payments, let's boil it all down into a clear, straightforward plan.

The main takeaway? There is no single magic bullet. A layered strategy is the only real way to protect your revenue and your customers' trust.

Relying on just one method, like a simple rules engine, is like putting a single padlock on a bank vault. Real security comes from mixing different technologies—machine learning, behavioral analytics, and device fingerprinting—to build a defense that’s smart, flexible, and hard for fraudsters to crack.

Activate and Tune Your Tools

Your first move, and the one with the biggest impact, is to turn on the fraud tools you already have. If you use a processor like Stripe, you likely have access to powerful features like Stripe Radar. Don't let them sit idle.

Get into the settings and create custom rules that make sense for your specific business. Decide what your tolerance is for risk and set clear thresholds for what gets approved, flagged for review, or blocked outright.

The goal is to find that sweet spot between tight security and a smooth customer experience. You're building a wall to keep criminals out, not a maze that frustrates legitimate buyers and kills your sales.

Define Your Response Workflow

Catching a problem is only half the job. What you do next is what actually saves your money.

Create a clear, documented process for your team to follow whenever a fraud alert pops up. This plan should spell out the exact steps for manual reviews, how to handle customer disputes, and the protocol for dealing with chargebacks. A solid process takes the panic and guesswork out of the equation, turning chaos into a calm, controlled response.

For a deeper look at building this kind of resilience, this practical framework to improve security posture is a great resource for getting ahead of fraud.

Monitor, Measure, and Adapt

You can't fix what you don't measure. Keep a close watch on your key metrics.

Your chargeback rate, false positive rate, and approval rate aren't just numbers on a screen; they're the vital signs of your business's health. Tracking them lets you spot new threats, see if your rules are working, and tweak your strategy over time. This data-first approach keeps you nimble, protecting your business today while getting it ready for whatever comes next.

Frequently Asked Questions

Putting all this theory into action might seem like a heavy lift, but you can build a solid fraud detection strategy more easily than you think. Let's tackle some of the most common questions that come up.

How Fast Does Fraud Detection Really Need to Be?

It has to be practically invisible. Think about your own online shopping experience—you expect instant approvals. Any delay feels like a glitch and can be enough to make you abandon your cart.

This means fraud detection in online payments has to happen in the blink of an eye. We're talking milliseconds. The system needs to analyze the transaction, score the risk, and make a decision before the customer even finishes clicking "confirm," keeping the checkout flow smooth for good customers and stopping fraud in its tracks.

How Can I Stop Fraud Without Blocking Real Customers?

This is the million-dollar question, and it all comes down to balance. If your rules are too aggressive, you’ll get a lot of "false positives"—legitimate purchases that get flagged as fraudulent. This doesn't just frustrate your customers; it directly costs you sales.

The solution is to layer your defenses. Don't just rely on a set of hard-and-fast rules. Bring in machine learning and behavioral analytics to look for more nuanced patterns. These tools are much better at telling the difference between a real person and a scammer, which drastically cuts down on good customers getting blocked.

Keep a close eye on your false positive rate. If that number starts to creep up, it’s a big red flag that your rules are too tight and you're starting to lose good money.

I Have a Small Budget. Where Do I Even Start?

You don't need a huge budget to make a real impact. The best place to begin is with the tools you already have. Your payment processor, like Stripe, likely has powerful, built-in fraud prevention tools. Start by turning those on and configuring them properly.

Focus on a few simple rules that address the most common fraud you've seen so far. Pair that with a basic manual review process for any transactions that seem a little suspicious. This simple setup creates a strong starting point you can improve on as you grow.

Ready to manage your affiliate program with built-in security? LinkJolt offers robust fraud protection to keep your partnerships profitable and secure. Start scaling your affiliate program safely today.

Watch Demo (2 min)

Trusted by 300+ SaaS companies

Start Your Affiliate Program Today

Get 30% off your first 3 months with code LINKJOLT30

✓ 3-day free trial

✓ Cancel anytime