How to Avoid Affiliate Marketing Scams

How to Avoid Affiliate Marketing Scams

Ollie Efez

September 21, 2025•19 min read

Affiliate marketing is built on a simple, powerful promise: you only pay for real results. But that promise shatters when affiliate marketing scams creep in.

Think of it this way. A good affiliate is like a trusted local guide who recommends a fantastic hidden gem of a restaurant and earns a small, well-deserved tip. A scammer, on the other hand, is the guide who steers you toward a terrible, overpriced tourist trap just to pocket a massive kickback. They turn your performance channel into a money pit.

The Hidden Costs of Trusting the Wrong Partner

At its heart, affiliate marketing runs on trust. You give partners—your affiliates—the green light to represent your brand and bring in customers, and you agree to pay them a commission when they do. It’s a brilliant model when everyone plays fair. The problem is, this very reliance on trust is what makes it such an attractive target for fraudsters.

When that trust is broken, the fallout is much bigger than a few unearned commissions. Scammers flood your system with junk data, making it impossible to tell which of your marketing efforts are actually working. Imagine basing your entire quarterly budget on reports that show one affiliate knocking it out of the park, only to find out later that 90% of their "sales" came from bots.

The Ripple Effect of a Single Bad Actor

One bad partner can poison your entire marketing program. Their sketchy tactics don't just steal from your budget; they undermine the integrity of your whole operation and create a huge mess for your team to clean up.

The damage typically spreads in a few key ways:

- Wasted Ad Spend: You’re essentially throwing money away by paying commissions for fake leads, bogus sales, or traffic that was never human to begin with.

- Skewed Analytics: Your performance data becomes a work of fiction. This leads to poor strategic planning and pouring money into channels that aren't actually delivering.

- Brand Damage: Scammers often resort to spam, cookie stuffing, or ad hijacking—tactics that can seriously tarnish your company’s hard-earned reputation.

- Legal Complications: Shady practices can land you in hot water, leading to compliance violations and expensive legal battles. Knowing the risks is key, as even a seemingly solid agreement can have hidden traps. You can learn more in our guide on what happens when affiliate contracts backfire.

The real danger of affiliate marketing scams isn't just the money you lose today. It's the bad decisions you make tomorrow based on the fraudulent data they create.

Ultimately, these parasitic partners turn what should be a powerful growth engine into a liability. Learning to spot the warning signs isn't just about stopping fraud—it's about protecting your budget, your brand, and your ability to make smart business decisions. This guide will walk you through how to identify and cut out these threats, so your affiliate program can drive the real, profitable growth it's supposed to.

Unpacking the Real Financial Damage of Affiliate Fraud

Affiliate scams are way more than a minor headache. Think of them as a slow, silent leak in your marketing budget—a leak that doesn't just drain cash but also poisons your data and leads to some seriously flawed business decisions.

When a fraudulent partner worms their way into your program, they set off a chain reaction of financial problems. These aren't just one-off incidents; they systematically chip away at the trust that performance-based marketing is built on, making it nearly impossible to figure out what’s actually working.

It's More Than Just Wasted Commissions

The most obvious hit is paying out commissions for fake sales or leads. But the true financial damage runs much, much deeper, spreading into different parts of your business.

These hidden costs are where the real pain is:

- Skyrocketing Customer Acquisition Costs (CAC): You're essentially paying for phantom customers. This artificially jacks up your CAC and makes your entire marketing funnel look less efficient than it really is.

- Drained Team Resources: Instead of focusing on growth, your team gets bogged down chasing ghosts—investigating suspicious clicks, cleaning up messy data, and managing bad-faith partners. That’s time and talent you’ll never get back.

- Compromised Performance Data: This is the most dangerous part. Bad data tells you a story that isn't true. You might see a channel "crushing it" and pour more money into it, not realizing it's all bots. Meanwhile, your legitimate, hard-working affiliates are starved of the budget they deserve.

When your analytics are telling you lies, you can't make smart decisions. This can send your entire marketing strategy veering off course for months, if not years. The problem is so widespread that it can even mess up how commissions are awarded, sometimes cheating your best partners out of the credit they've earned. You can dive deeper into this issue by reading about the dark side of affiliate attribution.

The Staggering Numbers and Real-World Scams

This isn't just theory. The scale of affiliate fraud becomes painfully clear when you look at the real stories and hard numbers.

One of the most notorious examples involved an eBay "super-affiliate" who managed to siphon off more than $28 million through a scheme called "cookie stuffing." He found a way to take credit for thousands of sales he had nothing to do with. And he's not alone. In 2020, marketers lost a staggering $1.4 billion to affiliate fraud.

The true cost of affiliate fraud isn’t just the money stolen through commissions. It’s the opportunity cost of misallocated budgets, the wasted hours of your team, and the erosion of trust in your performance data.

These figures hammer home a critical point: if you're running an affiliate program without serious fraud prevention, you're leaving the door wide open. Being proactive isn't just a good idea; it's an essential defense to protect your bottom line and the integrity of your marketing. You simply can't afford to ignore this threat.

How Common Affiliate Marketing Scams Work

To stop affiliate marketing scams, you first have to get inside the mind of the scammer. They rely on a playbook of deceptive, often technical, tricks designed to pocket commissions for sales and leads they never actually earned.

Once you peel back the layers and see how these schemes work, their telltale signs become much easier to spot. It's like learning the tells of a poker player; once you know what to look for, you can see their bluffs coming a mile away.

Most common scams are all about exploiting the very systems meant to track legitimate affiliate performance. They turn your own tools against you.

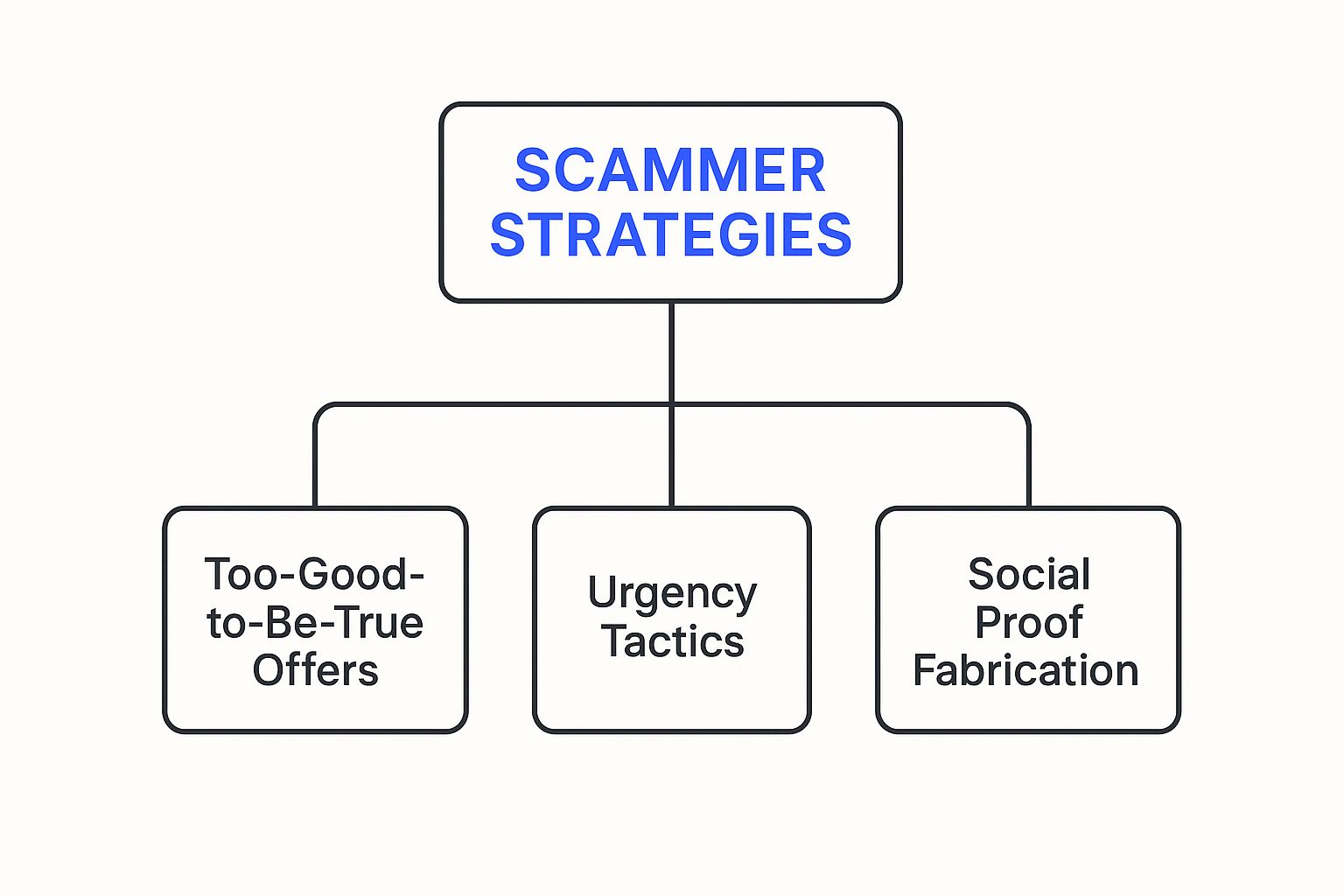

As you can see, these scammers build a foundation of deception by mixing unbelievable promises with high-pressure tactics and fake social proof. It's all about creating an illusion of legitimacy. Now, let’s dive into the technical tricks they use to pull it off.

The Deception of Cookie Stuffing

One of the oldest and most widespread scams in the affiliate world is cookie stuffing. At its core, this tactic is all about a fraudster taking credit for a customer's purchase without ever influencing their decision to buy.

Imagine a sneaky salesperson who sees you browsing a store. Right before you go to pay, they slip their business card into your shopping bag. The cashier finds the card, assumes that salesperson helped you, and gives them a commission. They did nothing, but they got paid.

That’s exactly how cookie stuffing works online. A scammer forces an affiliate tracking cookie onto a user's browser, usually without them ever knowing.

They can do this in a few ways:

- Pop-up Ads: A user visits the scammer's website, and a hidden pop-up loads your site in the background, dropping their affiliate cookie onto the user's browser.

- Hidden iFrames: A tiny, invisible 1x1 pixel iFrame on the scammer’s site can load your page, placing their cookie on the visitor's browser just as effectively.

- Malicious Scripts: Some scammers run scripts that automatically drop multiple affiliate cookies for dozens of different merchants as soon as a user lands on their page.

The user might then go to your site on their own days or weeks later and make a purchase. Because the scammer's cookie is already there, that fraudster gets the commission for a sale they had zero part in. This doesn't just drain your marketing budget; it steals credit from the legitimate affiliates who actually did the work.

Manufacturing Fake Leads and Traffic

Another go-to tactic is generating fake leads or completely fabricated traffic. This is a huge problem for affiliate programs that pay per lead (PPL) or pay per click (PPC). Scammers essentially invent phantom customers to collect easy payouts.

Think of it like a contest where the prize goes to whoever has the most raffle tickets. Instead of earning tickets, a scammer just prints thousands of fakes and stuffs the box. They haven't found any real participants, but they’ve rigged the system to win.

Fraudsters have a few methods for this:

- Bot Traffic: They program sophisticated bots to visit websites, click on affiliate links, and even fill out lead forms using stolen or fake information.

- Stolen Data: Scammers buy lists of stolen personal data and use it to populate your lead forms, making the leads look legitimate at first glance.

- Incentivized Clicks: Some affiliates use services to pay people from low-cost regions a few cents to click links or fill out forms, which results in a flood of low-quality leads with no interest in ever buying.

This kind of fraud is especially damaging. It doesn't just waste money—it pollutes your entire sales pipeline with useless data. Your sales team ends up chasing ghosts, and your marketing analytics become completely unreliable.

Hijacking Your Brand and Traffic

More aggressive scams involve directly hijacking your brand's reputation and traffic. The two most common ways they do this are through typo squatting and ad hijacking.

Typo squatting, sometimes called URL hijacking, is when a scammer registers domain names that are common misspellings of your brand. For example, if your site is YourBrand.com, they might buy up YourBrnd.com or Your-Brand.com. They then set up these fake domains to redirect to your real site—but through their affiliate link. They collect commissions from users who simply made a typing mistake.

Ad hijacking is even more brazen. Here, a fraudulent affiliate will start bidding on your own branded keywords in paid search campaigns, which almost always violates an affiliate program's rules. They might even create ads that impersonate your official brand, confusing customers and stealing traffic that should have come directly to you for free.

The customer clicks the scammer's ad, lands on your site via an affiliate link, and the fraudster gets paid for a customer you would have acquired anyway.

Affiliate Scam Tactics At a Glance

To help you keep these schemes straight, here's a quick summary of the most common tactics fraudsters use to exploit affiliate programs.

Understanding these common scams is the first and most critical step. Once you know what you're up against, you can start building a solid defense to protect your brand and your budget.How to Spot the Red Flags of a Fraudulent Affiliate

To run a secure and profitable affiliate program, you need to stop being a passive manager and start thinking like a proactive detective. Protecting your brand from affiliate marketing scams means learning to spot the subtle clues that tell you something isn't right.

Think of your affiliate analytics as an EKG for your program's health. A good, honest affiliate generates a steady, predictable rhythm of clicks and conversions. A scammer, on the other hand, creates chaotic, unnatural spikes that should set off alarm bells immediately.

Keeping a close watch is crucial because affiliate fraud isn't just a minor headache; it's a global problem with huge financial consequences. In 2023 alone, advertisers lost an estimated $84 billion to ad fraud. A big chunk of that came from sophisticated affiliate scams like ad hijacking and cloaking, all designed to trick you into paying for fake results. You can read more about the growing impact of affiliate abuse and see just how much these schemes can siphon from marketing budgets.

Analyzing Suspicious Performance Data

Your first line of defense is your own data. Fraudulent affiliates almost always leave behind a digital trail, and it’s pretty easy to spot if you know what you’re looking for.

Make a habit of regularly auditing your affiliate performance metrics. Be on the lookout for these kinds of anomalies:

- Sudden, Unexplained Traffic Spikes: Did clicks from an affiliate suddenly skyrocket overnight with no new promotion to explain it? That’s a classic sign of bot traffic. Real traffic growth is almost always gradual.

- Impossibly High Conversion Rates: If one affiliate is converting sales at a rate that's leagues above everyone else, it’s a massive red flag. This often points to self-referrals, sketchy incentivized traffic, or even attribution theft.

- Abnormal Click-to-Conversion Times: Check the time gap between a click and a sale. If conversions are happening in just a few seconds, you're likely looking at automated scripts, not genuine human behavior.

- Unusual Geographic Sources: Is a flood of traffic coming from countries where you don’t market or even have a customer base? That's highly suspicious and often indicates a click farm at work.

Behavioral and Communication Red Flags

Beyond the numbers, the way an affiliate acts can tell you a lot. Scammers tend to operate in the shadows and will do anything to avoid direct, honest communication.

Be wary of partners who show these behaviors:

- Unresponsiveness or Evasiveness: A legitimate partner will be happy to talk about their promotional methods. If an affiliate is vague, ignores your emails, or refuses to show you examples of their marketing, it’s a huge warning sign.

- Using Shady Promotional Tactics: Do some spot-checks on how your affiliates are representing your brand. If you find them using spammy email blasts, bidding on your branded keywords against your policy, or using typo-squatting domains, it's time to take action.

- Lack of an Established Online Presence: A credible affiliate almost always has a well-maintained website, blog, or social media presence that’s relevant to your industry. An affiliate with no real digital footprint is a major risk.

A healthy affiliate partnership is built on transparency. If an affiliate is unwilling to show you how they're generating traffic, it's because they have something to hide.

Monitoring for Suspicious Refund Rates

Finally, don't forget to look at your refund and chargeback data. This is often where the most blatant transaction fraud comes to light.

A key indicator is a high refund or chargeback rate that traces back to a specific affiliate's sales. This pattern usually happens when a scammer uses stolen credit cards to generate fake sales. They pocket the commission, and a few weeks later, you get hit with a chargeback when the real cardholder disputes the transaction. By then, the scammer has already been paid and is long gone.

By regularly cross-referencing your sales data with refund rates for each affiliate, you can quickly spot partners who are costing you more than they're worth. Staying vigilant and learning to recognize these red flags early is the best way to protect your budget, keep your data clean, and build an affiliate program that delivers real value.

Building a Fraud-Proof Affiliate Program

When it comes to affiliate fraud, playing defense isn't enough. The best way to protect your business is to go on offense, building a program that’s secure from the ground up. This means shifting your focus from just detecting fraud to actively preventing it from the very start.

Think of your affiliate program as a private club. You wouldn't just let anyone wander in off the street, right? You’d have a bouncer at the door. Applying that same level of scrutiny when you bring on new partners is your single most effective line of defense.

Establish a Rigorous Vetting Process

A tough, hands-on application process is your bouncer. It weeds out the bad actors before they can even get their hands on a referral link. Don't fall into the trap of auto-approving everyone who signs up—that's an open invitation for trouble. Instead, take the time to personally review every single application.

Here’s a simple checklist to get you started:

- Website and Content Quality: First, check out their online presence. Do they have a professional-looking website or active social media accounts? The content should be high-quality, actually relevant to what you sell, and completely free of spammy or sketchy material.

- Promotional Methods Disclosure: Make them tell you exactly how they plan to promote your brand. If they’re cagey or give you vague answers, that’s a huge red flag. Honesty is non-negotiable.

- Public Reputation: Do a quick Google search of their name or website. Look for reviews, forum discussions, or any whispers of past fraudulent behavior. An affiliate with zero digital footprint can be just as suspicious as one with a bad one.

This initial screening isn't just a formality; it's where you set the standard for your program's integrity.

Solidify Your Affiliate Agreement

Your affiliate agreement is more than just a piece of legal paper—it's the rulebook for your entire program. It needs to be crystal clear, leaving zero room for creative interpretations, especially when it comes to fraud. This document is your shield if you ever have to fire a partner or hold back commissions.

A vague affiliate agreement is basically a welcome mat for scammers looking for loopholes. Spell out exactly what’s allowed, what isn’t, and what happens when someone breaks the rules.

Your terms of service should explicitly ban common scam tactics. Clearly state that things like cookie stuffing, ad hijacking, typo squatting, and sending fake leads will result in immediate termination and forfeiture of all commissions. This protects you and gives your honest partners peace of mind.

And this is more important than ever. The affiliate marketing industry is set to be worth $18.5 billion by 2025, but a staggering 31% of marketers have dealt with fraud. With North America making up over 40% of the market, a strong defense is essential to keep your budget from becoming another statistic. For more on this, you can discover more insights about affiliate marketing's growth and risks.

Deploy Modern Fraud Detection Technology

While a good manual review is crucial, you can't possibly watch every click and conversion around the clock. That's where technology becomes your best friend. Modern fraud detection tools act like a 24/7 security guard for your program, automatically flagging and even blocking suspicious activity as it happens.

These platforms use smart algorithms to spot patterns a human would almost certainly miss. They’re looking for tell-tale signs of fraud, like:

- Bot-driven traffic coming from data centers instead of real homes.

- Click fraud patterns, like an impossible number of clicks from one user.

- Conversion anomalies, like a sale being completed in just a few seconds.

- Proxy usage that hides where a user is really located.

By bringing in this kind of tech, you automate a huge chunk of your program's security. This frees you up to focus on what really matters: building great relationships with your legitimate, high-performing partners.

Of course, all of this relies on solid data. That’s why knowing how to fix your affiliate reports with the right software is so fundamental to program security. By combining a strict vetting process, an ironclad legal agreement, and powerful technology, you create a layered defense that makes your program a much, much harder target for scammers.

Got Questions About Affiliate Scams? We’ve Got Answers.

Even when you know what to look for, affiliate scams can be tricky. It’s one thing to understand the theory, but it’s another thing entirely when you’re staring at your dashboard, trying to figure out if an affiliate is a rockstar or a scammer. The lines can get blurry.

Let's clear things up. Here are some of the most common questions I hear from business owners and affiliate managers, along with straightforward, practical answers to help you handle these situations with confidence.

What Are the First Steps if I Suspect an Affiliate Is a Scammer?

If your gut is telling you something’s wrong with an affiliate, listen to it. But don't act rashly. The first thing you need to do is quietly gather evidence without tipping them off.

Start by diving into their performance data. Look for the classic red flags:

- A sudden, massive spike in traffic or conversions that comes out of nowhere.

- A suspiciously high number of sales all coming from the same IP address.

- Click-to-conversion times that are impossibly short (think under 10 seconds).

- A flood of traffic from weird or totally irrelevant countries.

Once you have some data that looks fishy, pause their commissions. Then, send them a professional email with specific, non-accusatory questions. Ask them to walk you through their promotional methods and provide proof, like screenshots of their ads or links to their content. How they respond—or if they respond at all—will usually give you your answer.

Are New Businesses More Vulnerable to Affiliate Scams?

Absolutely. New businesses and startups are often the number one target for affiliate scammers. Fraudsters know that new companies are hungry for growth and often don't have the experience or tools to catch them in the act.

Here’s why new businesses are a prime target:

- No Established Baselines: When you're new, you don't have historical data. It's tough to spot strange activity when you don't know what "normal" looks like yet.

- Limited Resources: Most startups can't afford dedicated fraud detection software or a full-time affiliate manager to watch every partner like a hawk.

- Pressure for Quick Growth: The desperate push for early traction can make businesses lower their guard and approve affiliates they shouldn't.

Scammers prey on enthusiasm and inexperience. For a new business, one of the best defenses is to manually and thoroughly vet every single affiliate from day one. Don't let the desire for quick wins make you an easy target.

How Can I Distinguish a Top Performer from a Fraudster?

This is the million-dollar question, isn't it? A genuinely amazing affiliate can bring in numbers that seem almost too good to be true. The real difference comes down to the quality and sustainability of their results.

A legitimate top performer drives high-quality traffic that actually cares about your brand. Their customers have a high lifetime value (LTV), they don't ask for refunds, and their chargeback rates are low. Their growth might be fast, but it’s usually tied to a new campaign or a brilliant marketing angle. They're also transparent and happy to talk about their methods.

On the other hand, a scammer's performance is a house of cards. They might drive a ton of conversions, but those "customers" lead to high chargeback rates, immediate subscription cancellations, and zero engagement after the sale. If an affiliate's incredible numbers come with terrible business outcomes and radio silence when you ask questions, you’re almost certainly dealing with a scammer, not a superstar.

Ready to build an affiliate program that’s secure from the start? LinkJolt provides the tools you need to manage partners, track real performance, and protect your business from fraud. Build partnerships you can trust with LinkJolt today.

Watch Demo (2 min)

Trusted by 300+ SaaS companies

Start Your Affiliate Program Today

Get 30% off your first 3 months with code LINKJOLT30

✓ 3-day free trial

✓ Cancel anytime