How do you find commission rate: A Practical Guide to Setting Strong Incentives

How do you find commission rate: A Practical Guide to Setting Strong Incentives

Ollie Efez

December 19, 2025•17 min read

Finding your ideal commission rate is part art, part science. It’s a blend of hard business metrics and a feel for the market. You need to start by calculating your Customer Lifetime Value (LTV) and Customer Acquisition Cost (CAC) to figure out what you can actually afford to pay. From there, you can measure that number against industry benchmarks, which for most e-commerce brands, often lands somewhere between 10-15%.

Why the Right Commission Rate Is a Game Changer

Nailing the perfect commission rate isn't just a math problem—it’s one of the most powerful levers you can pull in your business. It has a direct impact on your sales team's drive, your company's profitability, and even your ability to attract top-tier talent.

Too many businesses get stuck in the middle. They set a rate that’s too low to light a fire under anyone or so high that it eats away at their margins with every sale. This guide gives you a clear roadmap to stop guessing and turn your commission structure from a simple expense into a strategic tool for growth.

The Foundation of a Strong Commission Plan

Before you even think about picking a percentage, you have to get intimate with the core financial drivers of your business. A commission rate pulled from thin air is a gamble. One grounded in data becomes a predictable and powerful tool.

The real trick is to find that sweet spot between your internal financial realities and what the market expects.

The goal is to create a win-win scenario: affiliates are highly motivated to promote your products because the reward is worthwhile, and your business grows profitably because each sale strengthens your bottom line.

To get there, you first need to gather a few key pieces of information that will form the bedrock of your calculations. These metrics paint a full picture of your financial health and draw the lines you need to color within for a sustainable commission plan.

Before we dive into the formulas, here's a quick look at the essential data points you'll need to pull together.

Key Factors for Determining Your Commission Rate

Having these four inputs ready will make the next steps much smoother and ensure your final decision is based on solid ground, not guesswork. Let's break down how to find and use each one.Ground Your Commission Plan in Core Business Metrics

Picking a commission rate out of thin air is a fast track to shrinking margins and unpredictable growth. Before you even think about a percentage, you need to ground your decision in the financial reality of your business. A rate anchored in solid data becomes a reliable tool for scaling profitably, while one based on guesswork is just a liability.

The first step is getting brutally honest about what each new customer is truly worth to you. This is where two fundamental metrics come into play: Customer Lifetime Value and Customer Acquisition Cost.

Calculate Your Customer Lifetime Value

Your Customer Lifetime Value (LTV) is the total revenue you can reasonably expect from a single customer over their entire relationship with you. It’s a forward-looking metric. It tells you the long-term value of an acquisition, not just the profit from that first sale.

A simple way to get a handle on your LTV is:

- LTV = (Average Purchase Value) x (Average Purchase Frequency) x (Average Customer Lifespan)

For example, if you have a SaaS customer paying $50/month who typically sticks around for 24 months, their LTV is a cool $1,200. Knowing this number helps you understand the absolute maximum you can justify spending to bring that customer on board.

Determine Your Customer Acquisition Cost

Next up is your Customer Acquisition Cost (CAC). This is the total cost of all sales and marketing efforts you spend to get one new customer to sign up. It’s a critical piece of the puzzle because your affiliate commission is a direct part of this cost.

To find your CAC, you just need to divide your spending by your results:

- CAC = (Total Sales & Marketing Costs) / (Number of New Customers Acquired)

This number should include everything—ad spend, content creation, sales salaries, you name it. A high CAC can quickly eat you alive, so keeping this number in check is non-negotiable. For a deeper look at this, our guide on customer acquisition cost calculation breaks it down even further.

Your LTV has to be significantly higher than your CAC for your business to have a pulse. The gold standard for a healthy LTV-to-CAC ratio is 3:1 or better—meaning for every dollar you spend to get a customer, you get at least three dollars back over their lifetime.

Weave in Your Profit Margins

Finally, you have to look at your profit margins. LTV and CAC tell you about revenue and cost, but profit is what keeps the lights on. It’s simple: if your product has a 70% gross margin, you have a lot more room to play with commission rates than if your margin is only 20%.

Your commission has to come out of your profit, not your revenue. Always run the numbers after accounting for your cost of goods sold (COGS). Let's say you sell a product for $100 and it costs you $40 to make and deliver (your COGS). Your gross profit is $60. Your entire acquisition cost, including the affiliate commission, has to fit comfortably inside that $60 bucket to stay profitable.

By starting with these three core metrics—LTV, CAC, and profit margins—you're building the financial guardrails for your entire commission plan. This is how you find a rate that fuels growth instead of just draining your bank account.

A Practical Formula for Calculating Your Commission Rate

Alright, let's turn those business metrics into a real, actionable number. You don't need some convoluted algorithm to figure out your commission rate. What you need is a straightforward formula that keeps your business profitable while making your offer attractive to partners.

The best way to do this is to work backward from what your business can actually afford to spend.

This starts with figuring out your "commission budget" per sale. This isn't a random number you pull out of thin air—it's the absolute maximum you can spend on commissions for a single new customer while still hitting your profit goals. Think of it as your financial guardrail.

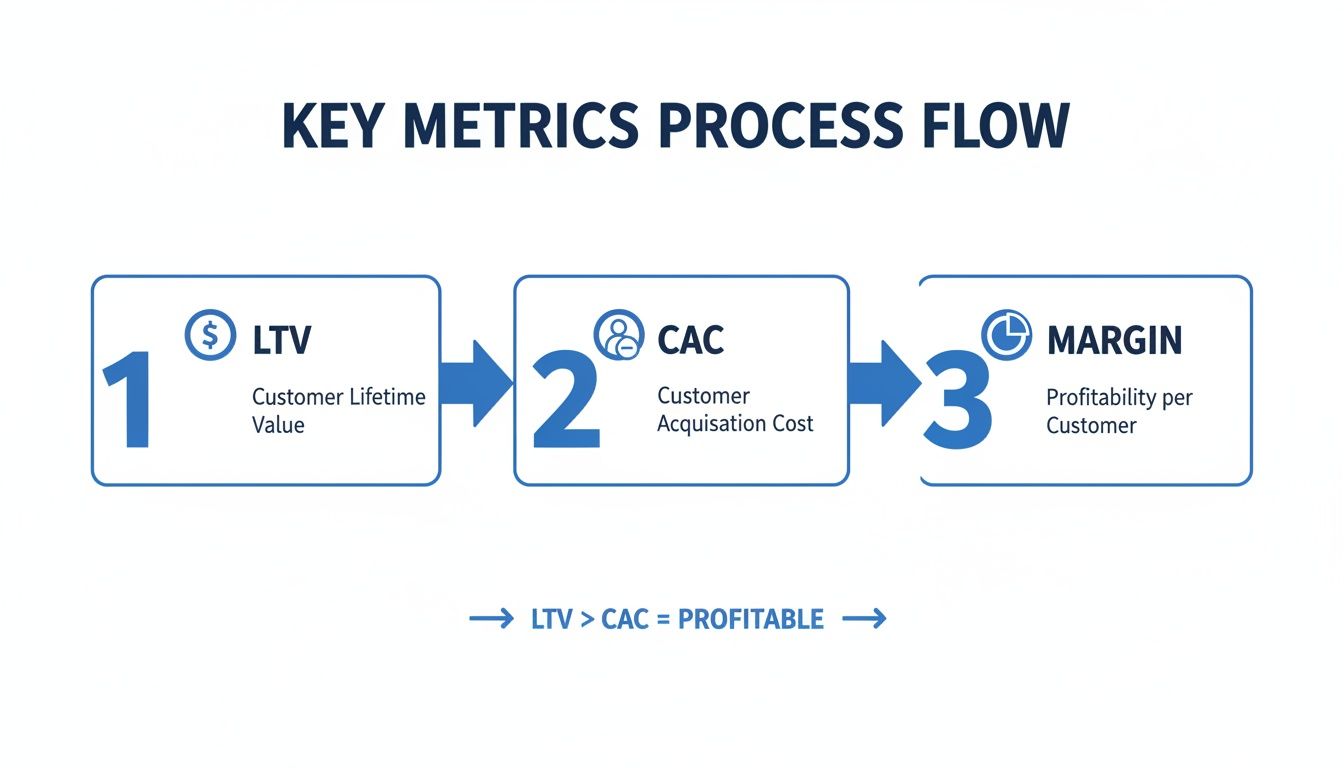

This graphic breaks down how the key metrics flow into each other.

Each piece of the puzzle—LTV, CAC, and Margin—builds on the last, giving you a clear path to a commission structure that won't sink your business.

Calculating Your Maximum Commission Budget

The simplest way to pin down your commission budget is to anchor it to your Customer Lifetime Value (LTV) and your target Customer Acquisition Cost (CAC).

A healthy business model often aims for an LTV to CAC ratio of 3:1. In plain English, this means for every dollar you spend to get a customer, you should expect to make three dollars back over their lifetime. This ratio is your starting point.

Maximum CAC = LTV / 3

Now, this isn't your commission rate just yet. It's the total amount you can afford to spend on all acquisition activities for one customer—that includes your ad spend, marketing tools, sales team costs, and everything else. Your affiliate commission is just one slice of that pie. From this Maximum CAC, we can carve out a dedicated budget for your affiliate partners.

Scenario One: A SaaS Product Example

Let's make this real with a SaaS company. Imagine your product has a solid LTV of $1,500.

- Maximum CAC: $1,500 / 3 = $500

This $500 is your total budget to land one new customer. Now you have to decide how much of that budget you want to give to the affiliate channel. If you decide to allocate 50% of your acquisition budget to affiliates, your commission budget per sale comes out to $250.

So, how do you turn that into a commission rate? It all depends on your pricing.

- If your product is $50/month (which is $600 in first-year value), that $250 commission would equal a 41.6% one-time payout on the first year's revenue.

- Alternatively, you could offer a recurring 20% commission. This would pay out $120 in the first year, keeping you comfortably within your $250 budget.

If you're having trouble visualizing this with your own numbers, a dedicated tool can make a world of difference. This free SaaS commission calculator helps you play around with different scenarios based on your own metrics.

Scenario Two: A Physical Product Example

The same logic applies perfectly to e-commerce, but the numbers and terms are a bit different. Let's say you sell a high-end backpack for $120.

- Product Price: $120

- Cost of Goods Sold (COGS): $40

- Gross Profit: $80

Your entire CAC, commission included, has to come out of that $80 gross profit. Let's say your other marketing costs per sale (like ad spend) average out to $25. That leaves you with $55 to cover your profit margin and the affiliate commission.

If you decide to offer a 15% commission rate on the $120 sale price, the payout would be:

- Commission Payout: $120 x 0.15 = $18

This leaves you with $37 in profit ($55 - $18), which is a pretty healthy margin. This simple math ensures every single affiliate sale is actually adding to your bottom line instead of slowly eating away at it. By starting with your profit, you build a program that's both sustainable and scalable from day one.

How Your Rate Stacks Up Against Industry Standards

Figuring out a commission rate based on your own metrics is the right place to start. But that number exists in a vacuum. To really know if your rate will actually attract affiliates, you have to hold it up against what everyone else is offering.

A rate that looks fantastic on your spreadsheet might be an absolute non-starter for experienced partners. On the flip side, a number that seems a bit low could actually be incredibly generous in a high-volume, low-margin industry. This reality check is what turns a calculated rate into a competitive one—a rate that brings in top talent without gutting your profitability.

SaaS vs. Tangible Products: A Tale of Two Models

The very nature of what you sell has a massive impact on commission expectations. In the Software-as-a-Service (SaaS) world, recurring revenue is king, which opens the door for compensation models that look very different from a one-and-done product sale.

For SaaS companies, it’s common to see affiliate commissions in the 10-30% range, paid out on a recurring basis. This is often for the first year of the customer's subscription. This model is designed to reward partners for bringing in sticky customers who deliver long-term value. A high LTV makes these seemingly generous payouts possible because the return is spread out over months, sometimes even years.

E-commerce brands selling physical products, on the other hand, almost always offer a one-time commission on the initial sale. These rates typically land somewhere between 5-15%. Because the transaction is a single event, the commission has to be paid from the profit of that one sale alone. With tighter margins on physical goods, there's just less room for higher percentages. Our detailed guide on sales commission percentages breaks down more examples of how these structures work in the real world.

The key takeaway here is context. A 20% recurring commission in SaaS and a 10% one-time commission in e-commerce might both be highly competitive in their respective fields. Don't just compare the numbers; compare the models.

A Look at Commission Rates by Industry

To really find your commission rate's place in the market, you need to look at established benchmarks. Every sector has its own unique sales cycles, deal sizes, and margin structures, which naturally leads to different standards for compensation.

Across the U.S., the average salary-to-commission split for sales roles is 60:40, which shows just how much variable pay motivates performance. From 2020 to 2025, SaaS sales reps typically saw base commission rates hovering around 10%, with a common range of 5-15%. Real estate agents, who deal with massive transaction values, usually earn 5-6% on a property sale.

Other sectors show different splits: retail sales has a 36% commission share, financial sales hits 32%, and insurance is around 33%.

- Financial Services: Commissions are often tied to assets under management or the value of policy premiums.

- Retail: Lower-priced items usually mean a lower commission percentage, but this is often balanced by a much higher sales volume.

- High-Margin Industries: Fields like pharmaceuticals can support much higher commission shares, sometimes reaching up to 35%.

To get a more tangible feel for potential earnings and see how your rate might translate into actual income for a partner, it's helpful to explore insights into how much affiliates realistically make. This perspective helps you see beyond just the percentage and understand the real-world value you’re actually offering.

Fine-Tuning Your Commission Structure for Better Results

Calculating that initial commission rate is an important first step, but it’s just the beginning. The market is always shifting, and your commission plan needs to be just as dynamic. The real magic happens when you treat your commission structure not as a static number, but as a living tool that you constantly refine to hit your business goals.

Moving beyond a simple, one-size-fits-all flat rate is where you unlock serious potential. You can start building a structure that actively rewards your top performers and encourages the specific behaviors you want to see.

Exploring Advanced Commission Models

A flat percentage is easy, but it often leaves money on the table. Tiered commissions are a fantastic way to level up. With this model, partners who cross certain revenue or sales thresholds unlock a higher commission rate.

For example, you might offer a base rate of 10% that jumps to 15% once a partner drives over $5,000 in sales for the month. This gamifies the process, giving your best partners a clear, motivating target to push for. Another great tool is an accelerator, which boosts the rate on all sales after a specific quota is met. This can be a huge motivator for high-achievers who’ve already crushed their goals.

Of course, whenever you adjust your plan, you need a solid process. When you’re ready to roll out changes, it’s always a good idea to review the best practices for modifying existing commission agreements to make sure everything is communicated clearly and properly documented.

A static commission plan rewards activity, but a dynamic, tiered structure rewards results. It shifts the focus from just making sales to making more sales, creating a powerful engine for scalable growth.

To help you decide what's right for you, let's break down some of the most common models.

Comparing Commission Structure Models

Choosing the right structure is all about aligning your incentives with your core business objectives. A SaaS company will get more value from a recurring model, while an e-commerce brand might thrive with a tiered system.Use A/B Testing to Find Your Sweet Spot

Guesswork is the enemy of optimization. For any affiliate or partner program, the best way to figure out what really works is to A/B test different commission models. You can segment your partners into different groups and see which structure drives the best results.

Here are a few tests you could run:

- A 15% one-time commission vs. a 10% recurring commission.

- A flat-fee payout vs. a percentage of the total sale.

- A standard rate vs. one with a performance bonus for high-quality leads.

Keep a close eye on your key metrics—conversion rates, average order value (AOV), and overall partner engagement. You’ll often be surprised by what the data reveals about the perfect balance between motivating your partners and protecting your margins.

Automate and Analyze with Modern Software

Trying to track tiers, tests, and payouts in a spreadsheet is a recipe for headaches and costly errors. This is where modern software becomes absolutely essential.

The global market for Incentive Compensation Management (ICM) software hit $2.22 billion in 2024 and is projected to soar to $8.97 billion by 2033. Businesses are catching on—the adoption of automated commission tracking has jumped by 41%, with AI integration climbing 33% to help optimize rates on the fly.

Platforms like LinkJolt automate these complex calculations, giving you real-time performance dashboards and the hard data you need to make smart decisions. This kind of agility lets you adapt your commission structure quickly, turning it into a genuine competitive advantage.

Still Have Questions? Let's Clear Things Up

Even with the right formulas in hand, it's completely normal to have a few nagging questions when you're trying to lock in the perfect commission rate. Let's tackle some of the most common ones I hear from founders and marketing leads. Getting these sorted out early will save you a ton of headaches down the road.

One of the first things people ask is how paying an external affiliate differs from paying an internal salesperson. It’s a great question. Your employees are likely on a salary, so their commission is a performance bonus on top of a stable income. Affiliates are a different story entirely. They're betting on your product, and their commission is often their only incentive. That rate needs to be compelling enough to make their effort worthwhile.

Then there's the big one, especially for SaaS: how do you handle recurring revenue? Do you pay a huge one-time bounty or a smaller, ongoing percentage? A very popular and effective model is to offer 20-30% of the first year's revenue. You can pay this out monthly as it comes in or as a lump sum after a certain period. This structure generously rewards partners for landing loyal customers without locking you into paying commissions forever.

"Just Give Me a Good Number to Start With"

I get it. Sometimes you just want a straightforward number to plug in and see what happens. While your own numbers (LTV, CAC, margins) should always be your guide, a solid starting point for many direct-to-consumer brands is 10-15% of the sale price. It’s a competitive range that attracts good partners without completely wrecking your margins on physical goods.

But please, don't just set it and forget it. Context is everything. A rate that’s generous in one niche might be unsustainable in another. Always, always start with your own financial data before settling on a number.

And don't forget that benchmarks can vary wildly by region and industry. Take finance, for example. In the United States, a low-touch financial trading commission might average 1.7 cents per share, while a high-touch service can command double that at 3.4 cents. Over in the European Union, those same rates are standardized at 2 to 7 basis points. Market shifts can throw a wrench in these structures, too. As detailed in reports on global commission rate turbulence, something like a tariff change can spike transaction costs by 20-25%, forcing a complete rethink of commission models.

When Is It Time to Adjust Your Rates?

Setting your initial commission is just the beginning. The real skill is knowing when to change it. Your program will give you signals when something isn't right. Keep an eye out for these red flags:

- You Can't Attract New Partners: If your sign-up rate has flatlined, your offer probably isn't competitive enough to get people excited.

- Your Best Affiliates Go Quiet: Are your top performers suddenly promoting other brands more? They may have found a better deal elsewhere.

- Your Margins Are Getting Squeezed: If your own business costs have gone up, that once-profitable commission rate might now be putting you in the red.

Reviewing these signs regularly keeps your program healthy and ensures it stays aligned with your overall business goals.

Ready to stop guessing and start growing? LinkJolt gives you the tools to create, manage, and scale a high-performance affiliate program with ease. Automate payouts, track performance in real-time, and build a structure that attracts top talent. Get started with LinkJolt today!

Watch Demo (2 min)

Trusted by 300+ SaaS companies

Start Your Affiliate Program Today

Get 30% off your first 3 months with code LINKJOLT30

✓ 3-day free trial

✓ Cancel anytime