Commission Payment Software: Streamline Payouts with commission payment software

Commission Payment Software: Streamline Payouts with commission payment software

Ollie Efez

January 14, 2026•22 min read

Commission payment software is the tool that finally ends the chaos of manual payout calculations. It’s a specialized platform built for your partner and sales programs that intelligently tracks sales, calculates precise commissions based on your rules, and makes sure everyone gets paid correctly and on time.

Think of it as your automated accountant—one that turns a messy, time-consuming chore into a seamless, trustworthy system.

What Is Commission Payment Software Anyway?

Picture this: your business is booming. Your sales team is closing deals left and right, and your affiliate partners are driving a steady stream of traffic. Fantastic, right? But behind the scenes, you’re drowning in spreadsheets, manually calculating every payout, and triple-checking each number for errors that could poison your most valuable partnerships.

This scenario is incredibly common, and it’s the exact problem commission payment software was built to solve.

At its core, this software automates the entire process of managing and distributing commissions. It acts as a central hub connecting every sale or lead to the right person, whether they're an internal salesperson or an external affiliate partner. Instead of relying on manual data entry from ten different sources, the system tracks performance in real time and applies your specific commission rules automatically.

Moving Beyond Manual Methods

The old way of managing commissions—usually a janky patchwork of spreadsheets, manual payment processing, and endless email follow-ups—isn't just inefficient; it's a serious bottleneck to growth. Manual processes are magnets for human error, which can easily lead to underpayments or overpayments, completely eroding trust with your partners.

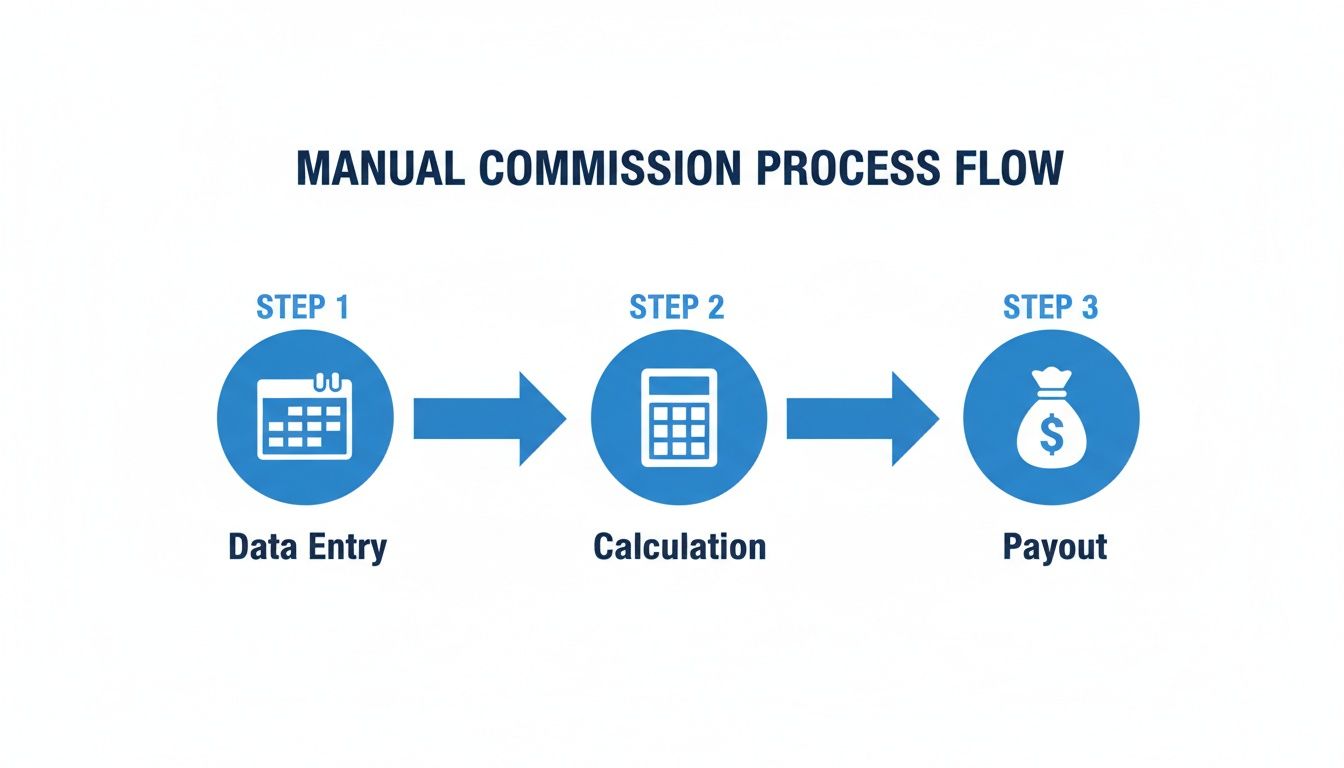

The typical manual workflow involves several painful, time-consuming steps.

This whole process is a minefield. Each stage, from data input to the final payout, is an opportunity for error and delay. Commission payment software collapses this entire fragile sequence into an automated, error-free workflow, freeing up your team to focus on strategy instead of spreadsheets.

This isn’t just a nice-to-have upgrade; it reflects a major market shift. The global commission software market is projected to grow at a 9.2% CAGR from 2026 to 2033, hitting USD 2.5 billion. That surge is happening because businesses are realizing they can't scale complex sales structures without automating the complex calculations that come with them.

Manual Spreadsheets vs Automated Software

Let's break down the real-world differences between sticking with spreadsheets and making the switch to dedicated software. The comparison is pretty stark.

Ultimately, spreadsheets are a starting point, but they become a liability as you grow. Automated software is built from the ground up to handle the complexity that growth brings.The Core Function of Commission Software

So, how does it all work under the hood? This software plugs into your existing sales and payment systems (like a CRM or a payment gateway) to pull in data automatically. From there, it handles several critical jobs:

- Attribution: It accurately assigns credit for each conversion to the correct affiliate or salesperson. No more guesswork.

- Calculation: The system applies your predefined commission rules—whether they're flat-rate, percentage-based, tiered, or recurring—to calculate the exact payout amount for every single transaction.

- Payment: It streamlines timely and accurate payouts through integrated payment processors, often letting you pay everyone with a single click.

The primary benefit is turning commissions from an administrative headache into a strategic asset. When partners and salespeople know they will be paid correctly and on time, their motivation and performance skyrocket.

In the end, this technology brings clarity and reliability to what has always been a messy process. You can learn more by reading our detailed guide on what a commission is and how it works. It lets you build sophisticated, motivating incentive programs without the fear of being crushed by the administrative burden, setting the stage for real, sustainable growth.

Essential Features Your Commission Software Needs

When you're shopping for commission payment software, it's easy to get lost in a long checklist of features. But the right platform isn't about having the most tools—it's about having the right ones to build trust, motivate your partners, and fuel real growth. A powerful platform is more than just a calculator; it’s the operational backbone of your entire partner program.

Think of it this way: the software has to eliminate the soul-crushing manual work. That's table stakes. But the best solutions go way beyond that, creating a professional and empowering experience for your partners. It's the difference between a tool that just spits out payments and one that helps you forge stronger, more profitable relationships. Let's dig into the non-negotiable features that define a top-tier platform.

Automated and Timely Payouts

Automated payouts are the bedrock of any partner program that people actually trust. This isn't just a nice-to-have; it's a promise. When your affiliates know they'll get paid on time, every single time, their confidence in your program skyrockets. This reliability is your single greatest retention tool.

Trying to handle payouts manually is a recipe for disaster. It’s riddled with delays and human error, which are the fastest ways to sour a good partnership. Automation takes those risks completely off the table. A solid system handles the whole workflow, from calculation to disbursement, making sure payments are spot-on and sent out on schedule without your team lifting a finger.

The result? A healthier, more engaged partner base. Affiliates will always gravitate toward a program that pays like clockwork over one where they have to chase down invoices.

Flexible Commission Structures

Your business doesn't stand still, so your commission plans shouldn't be set in stone either. The ability to create flexible commission structures is crucial for designing incentives that actually motivate partners and line up with your business goals. A one-size-fits-all approach just doesn't cut it.

Great commission payment software lets you easily set up and manage different models:

- Percentage-Based: Offer a slice of the sale. This is the most common model for a reason.

- Flat-Rate: Provide a fixed dollar amount for each conversion, perfect for lead generation.

- Tiered Commissions: Reward your top performers with better rates as they hit sales milestones.

- Recurring Commissions: Pay affiliates for the life of a subscription customer—an absolute must for any SaaS business.

This kind of flexibility allows you to tailor incentives for different types of partners, run special promotions on the fly, and tweak your strategy as your program grows. It transforms your commission plan from a static payment rule into a powerful performance engine. When looking at platforms, check for deep expertise in areas like payment integration in fintech to be sure the system can handle sophisticated financial workflows.

The goal is to create a true win-win. Your partners feel motivated to perform because the rewards are clear and achievable, and your business grows right alongside them.

A Professional Branded Partner Portal

Your partner portal is home base for your affiliates. It's where they grab their links, watch their performance, and see the money roll in. A generic, clunky portal sends a terrible message about your brand. A professional, branded portal, on the other hand, creates a sense of legitimacy and true partnership.

This portal should give affiliates everything they need to succeed, all wrapped in your company's branding. It needs to be intuitive, transparent, and empowering. The key pieces of a strong portal include:

- Real-Time Performance Dashboard: Affiliates have to see their clicks, conversions, and commissions as they happen.

- Easy Access to Marketing Assets: Give them logos, banners, and pre-written copy to make promoting your brand a breeze.

- Clear Payout History: A totally transparent record of past and upcoming payments builds an incredible amount of trust.

A well-designed portal is a clear signal that you're invested in your partners' success. This is a core part of any complete affiliate management software, turning your program into a professional ecosystem instead of just a transactional arrangement.

The Real-World Impact of Automated Payouts

Okay, let's move past a simple list of features and talk about what really matters: tangible results. Bringing automation to your commission payouts isn't just a minor operational tweak—it fundamentally changes how your business operates. The switch from manual spreadsheets to dedicated commission payment software creates a powerful ripple effect, boosting everything from team morale to your bottom line.

Think of it like upgrading from a paper map to a GPS. Sure, the paper map can get you where you're going, but it’s slow, full of potential mistakes, and a total nightmare on complex journeys. A GPS gives you real-time, accurate guidance, freeing you up to focus on the road instead of wrestling with the directions. That's exactly what automation does for your commissions.

Eliminating Errors and Rebuilding Trust

Manual data entry is the enemy of accuracy. Every single time a number is copied from one cell to another, you’re rolling the dice on making a mistake. A misplaced decimal or a simple typo can spiral into an incorrect payout, instantly damaging the trust you’ve worked so hard to build with your top-performing partners and salespeople.

These aren't just small slip-ups; they are expensive mistakes. Before automation was the norm, it wasn't uncommon for manual processes to have errors in up to 20-30% of all calculations. According to a report from the National Association of Sales Professionals, teams using commission software see an average 15% boost in productivity, driven by reliable calculations and error-free payments.

Automating the process takes human error out of the equation entirely. Payouts become consistent, reliable, and transparent—the foundation of any healthy, long-term partnership.

Achieving True Scalability

What happens when your partner program explodes from 10 affiliates to 1,000? With a manual system, your administrative workload doesn't just grow; it explodes. Your team gets buried under a mountain of spreadsheets, and the entire payment process grinds to a halt. This is where automation delivers a massive strategic edge.

The right software is built to scale right alongside you. It can handle a huge volume of transactions and partners without even breaking a sweat. This lets you grow your programs as aggressively as you want without worrying that your payment system will become a bottleneck.

Key scalability benefits include:

- Effortless Onboarding: Adding new partners is as simple as sending an invitation link, not creating another row in a spreadsheet nightmare.

- Complex Rule Management: You can easily set up and manage different commission tiers and rules for thousands of partners without manual oversight.

- Global Payouts: Pay partners anywhere in the world without having to navigate a dozen different complex payment systems.

This kind of scalability is what separates ambitious companies from the rest. It gives you the freedom to explore new growth strategies, knowing your operational backbone can handle whatever you throw at it.

Automation turns an administrative burden into a powerful engine for growth. When your system can handle unlimited scale, your business can too.

Freeing Up Your Team for High-Impact Work

Every hour your team spends manually calculating commissions is an hour they aren't spending on activities that actually grow the business. These are the high-value tasks that move the needle, but they’re always the first to be neglected when administrative work takes over.

By automating the grunt work of commission management, you free up your team to focus on what truly matters:

- Partner Recruitment: Finding and onboarding new, high-quality affiliates and resellers.

- Strategic Planning: Analyzing performance data to optimize commission structures and campaigns.

- Relationship Building: Nurturing relationships with your top partners to keep them engaged and motivated.

This shift in focus is profound. Your team transforms from being reactive accountants into proactive growth drivers. A smooth workflow for handling mass payouts ensures the financial side runs itself, letting your best people apply their talents where they can make the biggest impact. This strategic reallocation of resources is one of the most significant—and often overlooked—benefits of adopting modern commission software.

How to Choose the Right Commission Software for Your Business

Picking the right commission software can feel like a make-or-break decision, but having a clear game plan transforms it from a daunting task into a straightforward one. This is your practical guide to choosing a tool that not only fixes today's headaches but also grows with you tomorrow. It's all about finding a platform that works for your team, your partners, and your bottom line.

Think of it like choosing a new engine for your business. You wouldn't just glance at the horsepower. You’d need to know if it fits your existing setup (integrations), if it's reliable and secure (security), what the real running costs are (pricing), and if it's actually easy to use (user experience).

Let’s walk through each of these critical checkpoints.

Evaluate Critical Integrations

Your commission software won't be working in a silo. For it to be truly effective, it needs to connect seamlessly with the other tools you already lean on every day. These integrations are the digital handshakes that let data flow automatically, wiping out the manual data entry that’s a breeding ground for errors.

Before you even book a demo, take a moment to map out your current tech stack. What absolutely must talk to your new commission platform?

- CRM (Customer Relationship Management): Does it sync with Salesforce, HubSpot, or whatever you’re using to manage customer relationships? This connection is non-negotiable for accurately tying sales back to the right reps or partners.

- Payment Processors: Can it integrate directly with Stripe, Paddle, Braintree, or your gateway of choice? This is crucial for basing commissions on actual, successful payments—not just deals marked "closed."

- Accounting Software: A solid connection to tools like QuickBooks or Xero can put your financial reconciliation on autopilot, saving your finance team from hours of tedious cross-checking.

When you're looking at potential software, it's also helpful to have a solid grasp of how different payment processors function. A good comparison of payment gateways can provide valuable context for making the right choice.

Scrutinize Security and Compliance

Let's be blunt: you're handling sensitive financial data for both your company and your partners. Security and compliance aren't just features; they're the foundation of trust. A data breach isn't just expensive—it can shatter the relationships you've worked so hard to build.

You need to ask potential providers direct, pointed questions about how they protect your data.

- Data Encryption: Is all data encrypted both in transit (as it zips across networks) and at rest (while stored on servers)? Don't accept anything less than a "yes" on both counts.

- Compliance Certifications: Does the software meet major standards like SOC 2, GDPR, or CCPA? This is especially critical if you have customers or partners in different regions with different data laws.

- Access Controls: Can you set granular permissions? You need to control exactly who on your team can view or, more importantly, modify sensitive payout details.

Don’t let them get away with vague answers. A provider who takes security seriously will be happy to be transparent about their protocols and show you the documentation to back it up.

Understand the True Cost

Software pricing can be a minefield of confusing models and hidden fees that quietly chip away at your revenue. It's time to look past the sticker price and figure out what you'll actually be paying. The goal is to find a model that scales with your business in a predictable way.

Here are the most common pricing structures you'll run into:

- Subscription-Based: A flat monthly or annual fee, often tiered by the number of partners you have or the volume of transactions you process. Simple and predictable.

- Percentage of Revenue: The provider takes a small slice of the total commissionable revenue that flows through their system.

- Per-Transaction Fees: You get hit with a small fee for every single payout you send. This one can add up fast.

Be especially cautious of platforms that stack high transaction fees on top of a monthly subscription. To get the full picture, ask for a detailed pricing sheet and run a few "what-if" scenarios based on your projected growth. A transparent pricing model is often a good sign you’re dealing with a trustworthy partner.

Choosing the right software is a big decision, but it doesn't have to be a guessing game. By methodically evaluating each potential platform against these core criteria, you can move forward with confidence. The following checklist summarizes the key questions you should be asking.

Software Evaluation Checklist

Using this checklist as your guide ensures you cover all your bases. It helps you compare different options objectively and select a partner that truly understands your needs—setting your commission process up for success from day one.Grow Your Partner Program with LinkJolt

Understanding the theory is one thing. Putting it into practice is a whole different ballgame. The real challenge is finding a single platform that actually solves all the headaches we've talked about—from tedious manual work to building real trust with your partners. This is where LinkJolt stops being a concept and becomes the growth engine for your program.

We built LinkJolt from the ground up to fix the specific frustrations that come with scaling a partner program, especially for SaaS companies. Remember the nightmare of a clunky onboarding process that loses partners before they even begin? With LinkJolt, you can design and launch your entire affiliate program in minutes, not weeks.

This isn’t just about speed; it's about momentum. You can capture a partner's interest and get them promoting your business instantly, without getting bogged down by technical roadblocks or a frustrating learning curve. It's the simplicity you need to start building valuable partnerships today.

Eliminate Fees and Maximize Earnings

One of the most common frustrations in the affiliate world is the quiet death of your earnings by a thousand cuts. Platform fees, processing charges, and payout fees all add up, taking a significant bite out of both your revenue and your partners’ hard-earned commissions. It creates a constant, low-grade friction in your relationships.

LinkJolt flips that model on its head with a zero-fee payout model.

We believe you and your partners should keep what you earn. Period. By getting rid of transaction fees on payouts, we make sure the commissions you promise are the commissions your partners actually receive. This simple transparency builds incredible goodwill and makes your program far more attractive to top-tier partners who are sick of watching their income shrink.

This screenshot of the LinkJolt dashboard shows our clean, intuitive interface. It’s designed for clarity and control, so you can see key performance metrics at a glance without digging through confusing menus.

Built for SaaS with Seamless Integrations

Generic affiliate platforms just weren't built for the unique revenue models of SaaS businesses, especially when it comes to recurring subscriptions. LinkJolt is different. We designed it specifically for this ecosystem, which is why it integrates directly with the payment processors that power the SaaS world: Stripe and Paddle.

This native connection means your commission tracking is perfectly and automatically synced with your actual revenue.

- Flawless Recurring Commissions: Track and pay commissions for the entire lifetime of a customer’s subscription without ever touching a spreadsheet.

- Real-Time Accuracy: When a payment clears in Stripe or Paddle, the commission is logged in LinkJolt that very second.

- Automated Adjustments: Refunds and chargebacks? They’re automatically accounted for, protecting your program’s integrity without any manual intervention.

This deep integration means your data is always reliable. You can finally trust that your commission payouts are based on real, collected revenue, eliminating the reconciliation nightmares that plague so many programs.

With LinkJolt, your payment gateway is your single source of truth. This direct link between revenue and commissions creates an unbreakable, trustworthy system that scales effortlessly as you grow.

Discover New Partners and Fuel Growth

Let’s be honest—the biggest roadblock to scaling a partner program often isn’t managing payments. It’s finding high-quality partners in the first place. Most platforms just stop at tracking, but this is where LinkJolt gives you a unique and powerful advantage: an affiliate discovery marketplace.

Instead of you spending countless hours hunting for potential partners, LinkJolt brings them right to you. Our marketplace allows motivated affiliates to discover and apply to your program, creating a steady, inbound stream of partnership opportunities. You get to review and approve partners who are already interested in your brand, dramatically cutting down on recruitment time.

This turns your partner program into a self-sustaining ecosystem. While you focus on building great relationships with your current affiliates, new ones are constantly finding their way to your doorstep. LinkJolt isn't just another piece of commission payment software—it's a complete platform for building, managing, and, most importantly, scaling a successful and profitable partner program from day one.

We Get These Questions All The Time

Stepping into the world of automated commission management can feel like a big leap. It’s totally normal to have questions about how these systems handle the messy, real-world scenarios that spreadsheets tend to hide. Let’s tackle some of the most common questions we hear from businesses considering a switch to dedicated commission payment software.

Getting clear, direct answers to these practical concerns is the key to moving forward with confidence. We’ll cover everything from tricky payment reversals to setting custom commission rates and, of course, the critical importance of data security. The goal here is to iron out any final worries and show how a solid platform brings you peace of mind.

How Does the Software Handle Refunds and Chargebacks?

This is one of the first questions people ask, and for good reason. In any business, returns and payment disputes are just part of the game. The last thing you want is to pay a commission on a sale that gets refunded later—that’s a direct hit to your bottom line. Manually tracking these reversals is a nightmare of cross-referencing spreadsheets and trying to claw back funds.

Modern commission software handles this with a feature often called automated clawbacks.

Think of it as an "undo" button for commissions. Because the software is hooked directly into your payment processor (like Stripe or Paddle), it knows the instant a refund or chargeback happens. The system then automatically reverses the commission tied to that sale.

The process is seamless and completely transparent:

- A customer requests a refund for a product they bought through a partner's link.

- You process that refund in your payment system as you normally would.

- The commission software sees this event and automatically deducts the commission amount from that partner's next payout.

This completely eliminates awkward conversations and manual spreadsheet adjustments. The whole thing is handled by the system based on rules you set, ensuring everything is fair and accurate without any administrative headaches.

Can I Set Different Rates for Partners or Products?

Absolutely. A one-size-fits-all commission structure rarely works as you start to grow. Your top-performing partners deserve a better rate, and you might want to offer a special promotional commission to drive sales for a new product launch. This is where the flexibility of a rule-based system becomes a massive advantage.

Good commission payment software lets you create highly specific and granular commission rules. You are never locked into a single percentage for everyone.

For instance, you can easily set rules like:

- Partner-Specific Rates: Give your "VIP" affiliates a 25% commission, while standard partners get 15%.

- Product-Based Commissions: Offer a 30% commission on a new software product to get people promoting it, but maybe only 10% on a lower-margin add-on service.

- Tiered Structures: Create performance tiers where partners who generate over $5,000 in monthly sales unlock a higher commission rate on all their sales moving forward.

This level of control allows you to turn your commission plan into a strategic tool that actually motivates the right behaviors and lines up perfectly with your business goals.

The ability to customize commission rates on the fly is what separates a static payment tool from a dynamic growth platform. It lets you adapt your incentive structure to meet market demands and reward your most valuable partners appropriately.

How Secure Is This Software with Financial Data?

When you’re dealing with payouts and sensitive financial info, security isn’t just a feature—it's the absolute foundation of the system. Trusting a third-party platform with this data requires complete confidence in its security protocols, and any reputable provider will treat this with the seriousness it deserves.

Top-tier commission software platforms protect your data using a multi-layered approach that usually includes:

- End-to-End Encryption: All data is encrypted both in transit (as it moves between your systems and the software) and at rest (while stored on their servers). This means that even in the unlikely event of a breach, the data itself remains unreadable.

- Compliance with Major Standards: Look for certifications like SOC 2, which is a tough, third-party audit of a company's security, availability, confidentiality, and privacy controls. Following data privacy laws like GDPR and CCPA is also non-negotiable.

- Secure Access Controls: The platform should let you set granular user permissions, making sure only authorized team members can see or change sensitive payout information.

Choosing a platform with a proven commitment to security means you can manage your commission process without adding unnecessary risk to your business.

Ready to eliminate commission headaches and build a partner program that scales? LinkJolt offers a complete solution with zero-fee payouts, seamless Stripe and Paddle integrations, and a marketplace to discover new affiliates.

Get started with LinkJolt today and see how easy it is to manage and grow your partnerships.

Watch Demo (2 min)

Trusted by 300+ SaaS companies

Start Your Affiliate Program Today

Get 30% off your first 3 months with code LINKJOLT30

✓ 3-day free trial

✓ Cancel anytime